How Bookkeep Handles Sales Tax Withheld by TikTok Shop

Overview

When selling through marketplace platforms connected to Shopify—such as TikTok Shop—sales tax handling can differ significantly from standard Shopify storefront transactions. Bookkeep’s Shopify accounting automation is designed to correctly account for these differences and prevent common sales tax reporting and payment issues.

This article explains:

-

How marketplace-withheld sales tax typically works

-

How TikTok Shop differs from other marketplaces

-

Why Shopify’s Finance Summary can be misleading

-

How Bookkeep correctly handles these scenarios to prevent sales tax overpayment

Marketplace-Withheld Sales Tax: The General Case

For many marketplace platforms, sales tax is:

-

Collected by the marketplace

-

Withheld from the merchant

-

Remitted directly by the marketplace to tax authorities

In most cases, the sales tax withheld by a marketplace is deducted from the Shopify Payments balance. This makes the net payout appear lower, but the tax never actually belongs to the merchant and should not be recorded as a payable liability.

Bookkeep’s automation correctly:

-

Excludes marketplace-withheld sales tax from sales tax payable

-

Prevents overstating cash or liabilities

-

Ensures accurate revenue and settlement reporting

TikTok Shop: An Important Difference

With TikTok Shop, we’ve observed a key difference in how sales tax is handled:

-

Sales tax is withheld and remitted by TikTok

-

But the sales tax is NOT removed from the Shopify balance

-

Instead, the tax reduces the TikTok Shop balance

This distinction is critical from an accounting perspective.

Why this matters

If this behavior is not handled correctly:

-

Merchants may mistakenly overpay sales tax

-

Marketplace balances may not reconcile cleanly

Shopify Finance Summary Limitations

When reviewing the Finance Summary in Shopify, it’s important to note:

-

Shopify does not show marketplace-withheld sales tax in the Finance Summary

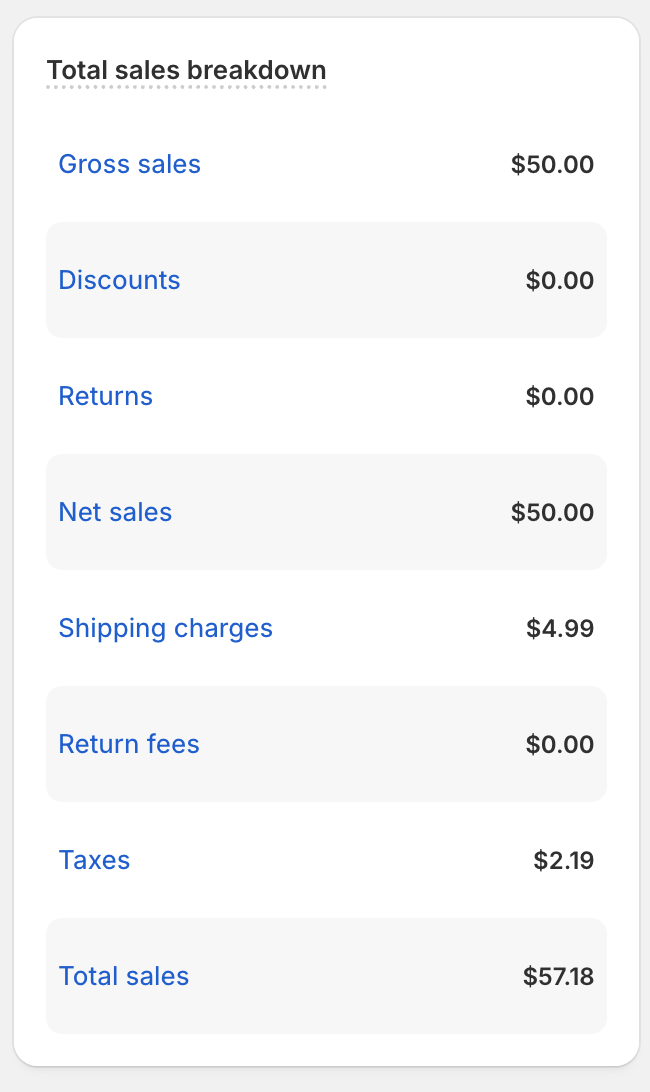

The Finance Summary shows $2.19 for tax collected without indicating whether it was also withheld.

-

TikTok-withheld sales tax is invisible at the Shopify summary level

-

This creates a persistent risk of sales tax overpayment if relying solely on Shopify reports

Without an accounting automation solution like Bookkeep, merchants may:

-

Assume the tax is still owed

-

Overpay their sales tax

-

Experience balance discrepancies that are difficult to trace

How Bookkeep Handles This Correctly

Bookkeep’s Shopify accounting automation is built to handle this scenario properly:

-

Recognizes that TikTok Shop is the party remitting the sales tax

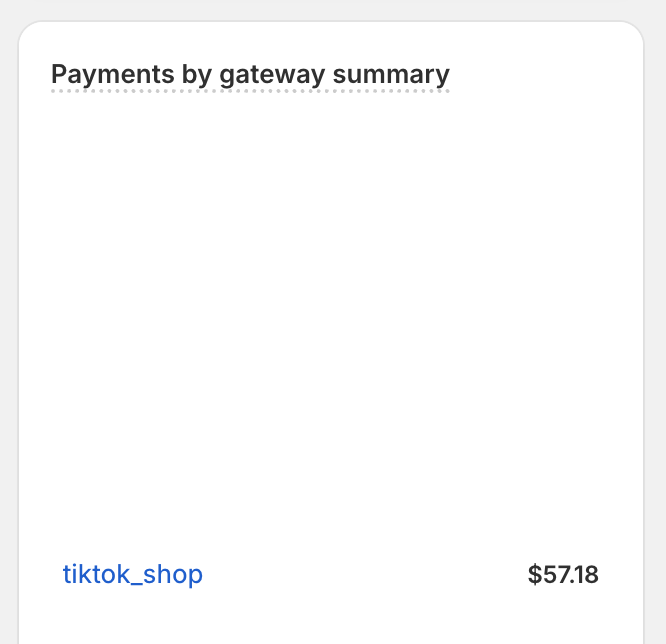

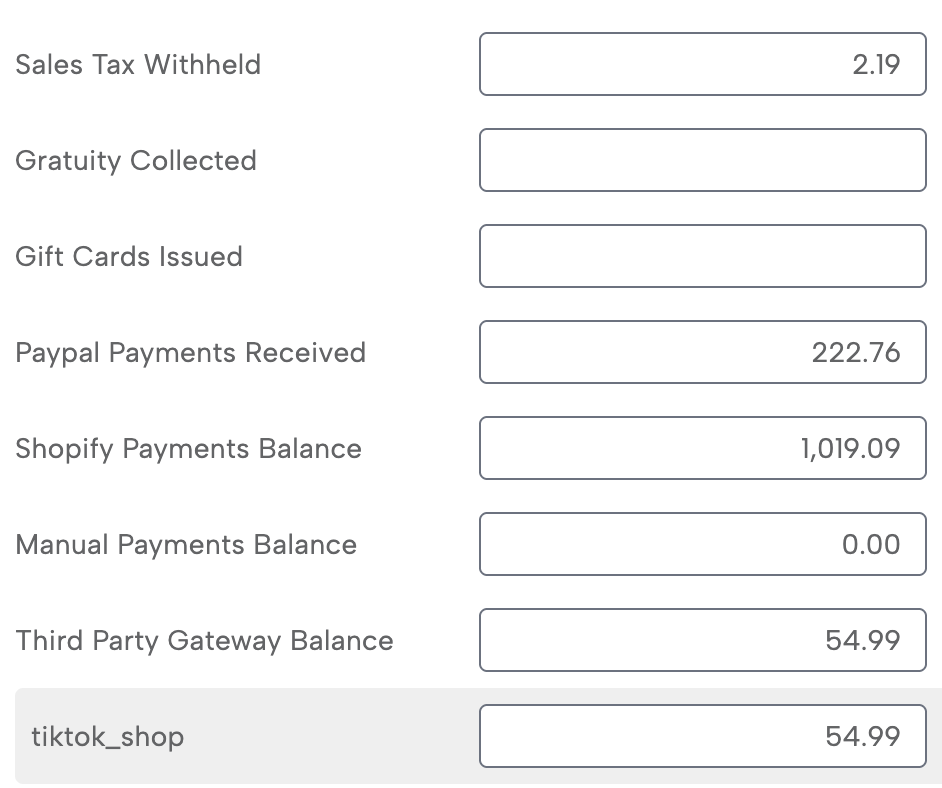

Shopify's Finance Summary shows the tiktok_shop balance as 57.18 not factoring in the withheld tax

-

Reduces the TikTok Shop marketplace balance by the withheld tax

Bookkeep reduces the tiktok_shop balance from 57.18 to 54.99 due to 2.19 of sales tax withheld

As a result:

-

Sales tax is not double-counted

-

Financial statements reflect the true economics of the transaction

-

Marketplace balances reconcile as expected

Why Bookkeep and Shopify Balances May Differ

When reviewing balances, you may notice the TikTok Shop payments balance in Shopify's Finance Summary does not match the TikTok Shop balance shown in Bookkeep.

This difference is expected.

Bookkeep reduces the TikTok Shop balance by:

- Any sales tax that TikTok will withhold and remit on your behalf

This ensures:

-

Accurate settlement accounting

-

No sales tax overpayment risk

Key Takeaway

Marketplace-withheld sales tax—especially with platforms like TikTok Shop—requires careful accounting treatment.

Bookkeep’s Shopify automation correctly handles these nuances, protecting merchants from:

-

Sales tax overpayment

-

Misstated balances

-

Incomplete Shopify reporting

If you have questions about how Bookkeep handles sales tax for a specific marketplace, our team is happy to help.