Understanding Sales Tax Automation on the Shop Channel on Shopify

Starting January 1, 2025, the Shop channel within Shopify will simplify sales tax compliance by automatically collecting, remitting, and filing taxes for all orders shipped to or within the United States. You may have seen the following in your Shopify dashboard:

This applies to orders placed through the Shop app, ensuring accurate tax handling for merchants across various jurisdictions. However, orders placed using Shop Pay on online stores are excluded from this automation. For more information, visit: https://help.shopify.com/en/manual/online-sales-channels/shop/sales-tax

Key Details

Scope of Tax Collection

- The Shop channel will collect taxes for orders shipped to states and territories with statewide sales tax, including the District of Columbia.

- Additionally, local sales taxes in Alaska will also be collected and remitted.

Exclusions

- Orders placed through Shop Pay from online stores will not be included in this automatic tax process.

Streamlining Shopify Accounting with Bookkeep: Tax Withheld Recognition Made Easy

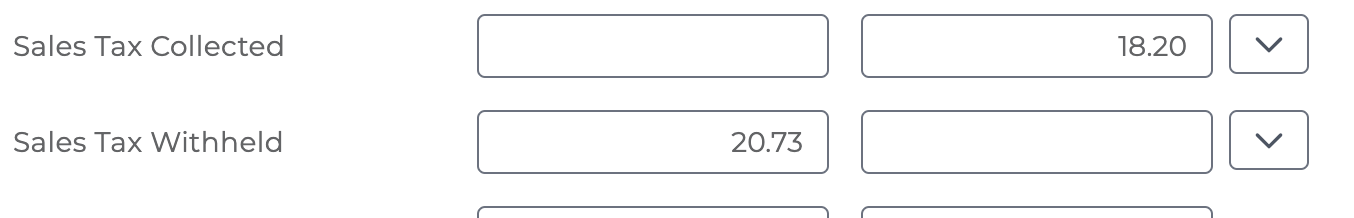

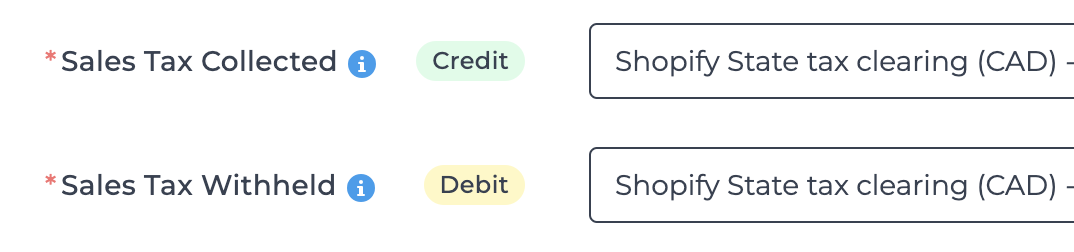

Bookkeep enhances Shopify accounting automation by creating detailed journal entries that clearly outline sales tax withheld and sales tax collected amounts, as illustrated below.

This allows merchants to:

Understand Tax Remittance Requirements

- With sales tax withheld broken out clearly in journal entries, merchants can easily identify tax amounts collected by state or jurisdiction.

- This clarity helps ensure accurate reporting and remittance to tax authorities.

Automate Accounting Tasks

- Bookkeep integrates seamlessly with Shopify’s Shop channel to automate the daily recording of sales and tax transactions.

- Each journal entry is broken down into key components, including gross sales, discounts, refunds, and taxes collected as well as withheld.

Prepare for Tax Season

- By providing a complete record of taxes collected and withheld, Bookkeep eliminates manual calculations and reduces errors, making it easier to prepare for tax filings.

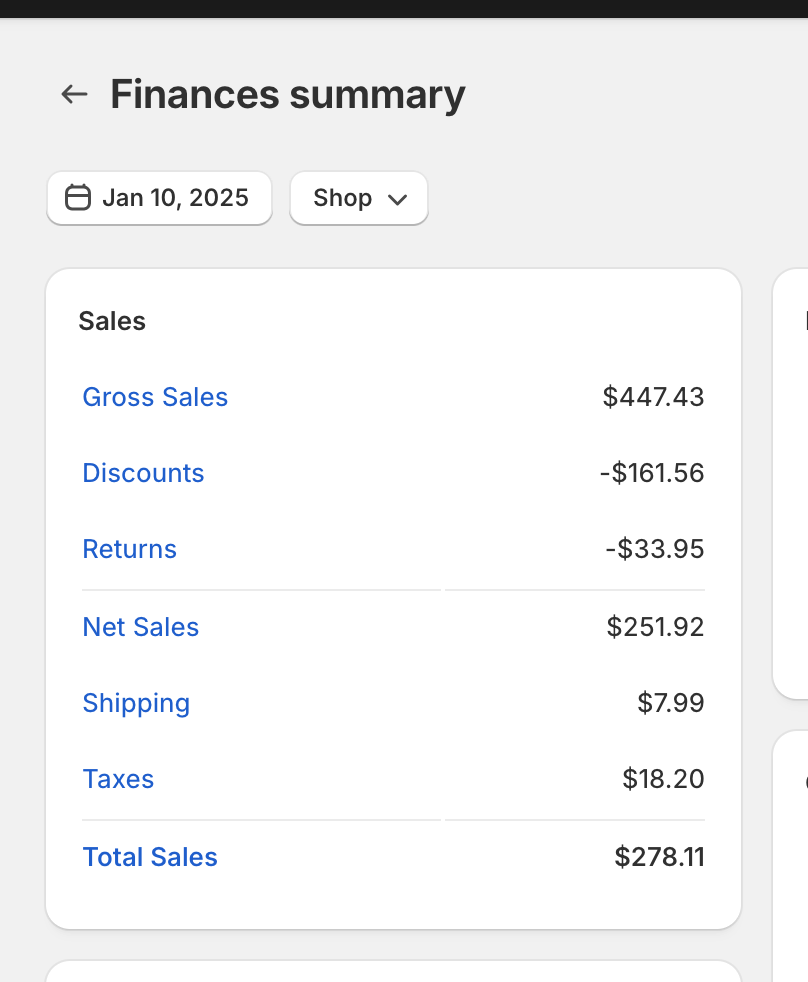

At Bookkeep, we’ve encountered instances where the withheld amount doesn’t match the collected amount displayed in the Shopify dashboard. This discrepancy often occurs when orders placed in 2024 are refunded in 2025. Refer to the example below:

The Shopify dashboard shows the collected amount and not the withheld amount:

By separating tax collected and tax withheld amounts, Bookkeep helps you accurately track these figures, ensuring you avoid overpaying your sales tax.

Impact of New Tax Rates on Customers Using QuickBooks Tax Rates in Canada

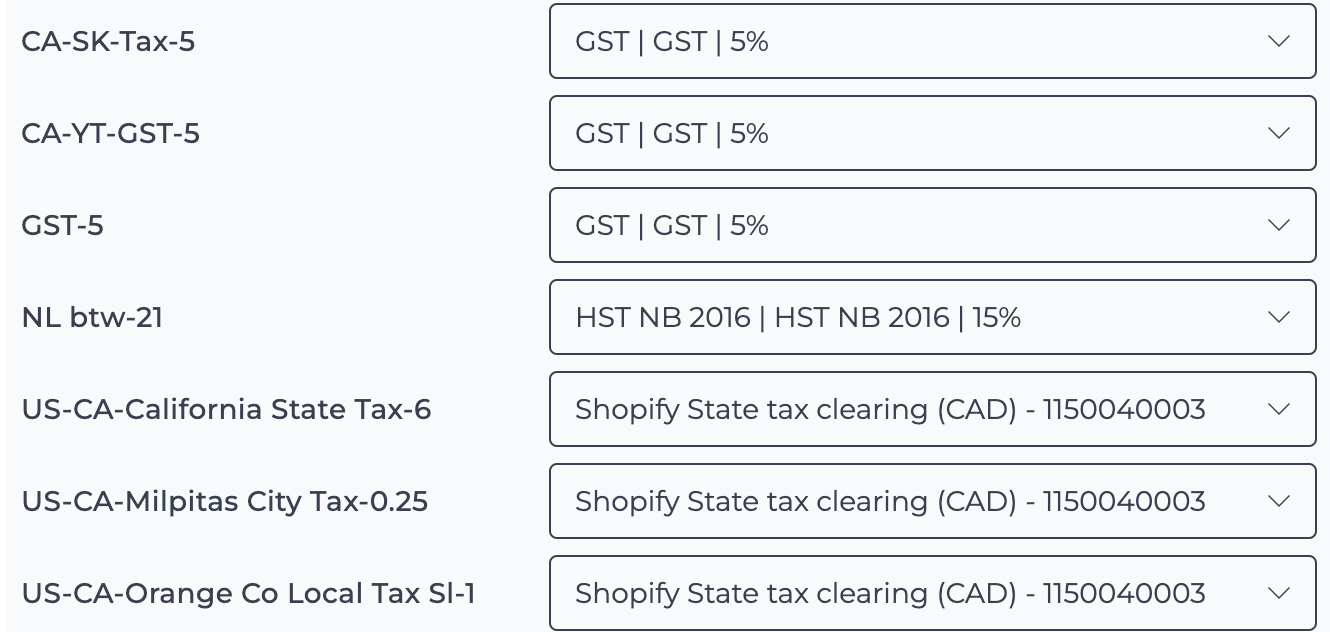

Due to Shopify's process of collecting and withholding tax for certain orders, you may observe new tax jurisdictions appearing in your tax collected and tax withheld subcategories. This change is particularly evident for customers utilizing Bookkeep’s tax rate solution for QuickBooks, as detailed in this guide: QuickBooks Online Canada Sales Tax.

For customers leveraging this solution, Bookkeep provides the ability to map Canadian tax lines to a specific tax rate in QuickBooks. Additionally, Bookkeep enables mapping U.S. tax lines to a corresponding account in QuickBooks. This streamlines the recognition of tax collected and withheld amounts for the Shop channel without requiring the creation of numerous new tax rates in QuickBooks. Refer to the example below for further clarity:

Additionally, with this new feature, you can map the top-line tax collected and tax withheld to a single account instead of mapping each individual U.S. tax subcategory. This approach consolidates all U.S. taxes into a single account, as demonstrated below:

However, it is still necessary to map each Canadian tax rate to its corresponding tax rate in QuickBooks.

Why Choose Bookkeep for Accounting Automation?

Daily Automation

Automatically posts journal entries for your Shop channel transactions.

Accurate Tax Reporting

Ensures all sales tax withheld is properly recorded and separated.

Time-Saving

Reduces manual entry and potential errors in tax reporting.

Comprehensive Integration

Works seamlessly with Shopify and other sales channels.

By leveraging Bookkeep, you can stay compliant with tax regulations, streamline your accounting processes, and focus on growing your business.

For more information, please visit Bookkeep.com or contact our support team at support@bookkeep.com.