Accounting for Shopify Managed Markets Orders with Bookkeep

As global e-commerce grows, Shopify’s Managed Markets solution—powered by Global-e—enables merchants to sell internationally while outsourcing currency conversion, tax handling, and compliance. Although Global-e simplifies cross-border sales, it introduces additional complexity for accountants who need clean, auditable records. This guide explains how to properly account for Shopify Managed Markets transactions using Bookkeep, ensuring accurate revenue recognition, expense tracking, and bank reconciliation.

Bookkeep captures these orders and payments on the ecommerce journal entry and also records any payouts connected to these orders on the deposit journal entry to aid with reconciliation.

1. Understanding the Global-e Flow

Global-e acts as an intermediary between your Shopify store and international customers. It manages pricing, taxes, shipping, and payment processing, providing customers with localized experiences. Funds are collected by Global-e and remitted to you, minus their fees and any applicable taxes. These orders often appear as "Flow Commerce" under Shopify Payments, as shown below:

According to Shopify: “Your transactions for fulfilled and eligible Managed Markets orders are collected and combined into a payout on the 1st, 8th, 15th, and 22nd day of each month. A payout is sent to your bank account within 1-3 business days and might take an additional 3 days to become available in your bank account. If your payout fails, then the payout is attempted again within 72 hours, and you receive a notification upon failure. You receive payouts in USD, and only for fulfilled and eligible orders.”

2. Recording Gross Sales

When an order is placed through a Global-e managed market, the sale should be recorded in your accounting system at the gross amount paid by the customer, including any taxes collected. This gross amount represents your total revenue from the sale before any deductions.

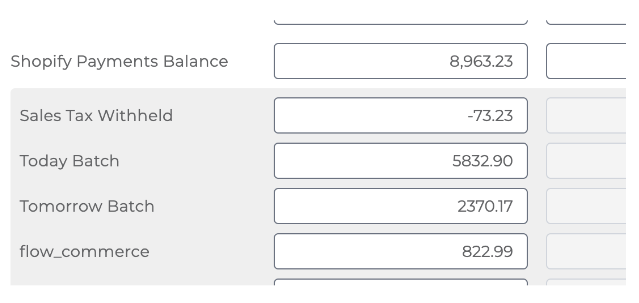

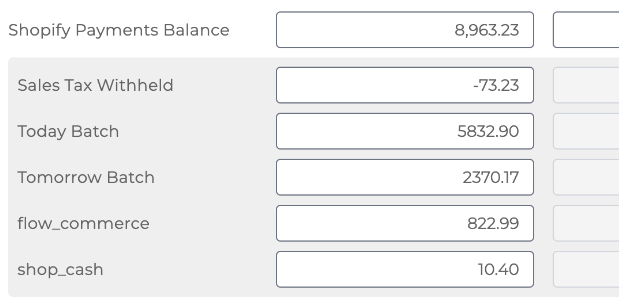

Bookkeep captures the sales on the sales summary template similarly to any other order. Payments for these Managed Market orders will appear under the Shopify Payments line, as these orders are paid out to your bank account connected to Shopify. This is why "Flow Commerce" appears under the Shopify Payments line below:

3. Capturing Fees, Taxes, and Withheld Amounts

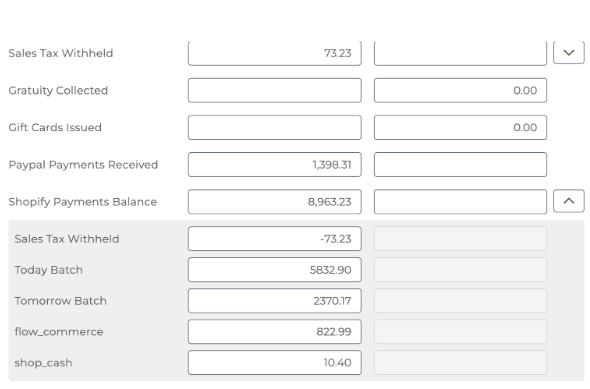

Global-e deducts transaction and service fees and may withhold taxes it remits directly. Bookkeep separates these deductions as fees (visible on the payout journal entry) and flags any channel-liable taxes as “tax withheld,” removing them from the Shopify Payments balance so your balance is accurately reflected.

Bookkeep records tax as being withheld when a Managed Market order indicates that the tax is channel liable. This is shown below by the sales tax withheld, captured on its own "sales tax withheld" line and removed from the "Shopify Payments balance" line since this tax will be remitted by Managed Markets and not to your bank account:

4. Reconciling Payouts

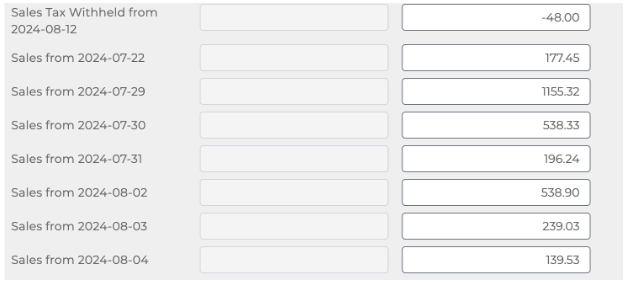

Bookkeep’s deposit journal entry breaks Shopify payouts down by sales day, making it easy to confirm that each day’s gross sales, fees, and withheld taxes tie out to the net deposit hitting your bank. This daily breakdown simplifies reconciliation. See below for an example:

This shows the amount being paid out to your bank account per sales day to help with reconciliation. In the example, sales tax is withheld for Managed Market orders, so it is removed in the top line.

Accurate accounting for Shopify Managed Markets requires proper gross revenue recognition, expense classification, and tax tracking. Bookkeep automates each step, reducing manual adjustments and ensuring compliance. If you have any questions, please contact support@bookkeep.com.