Shopify Multi-Bank Payout Mapping

Overview

If you're using multiple bank accounts for Shopify payouts — whether to separate cash flow across locations or entities — keeping your accounting accurate can be a major challenge.

Bookkeep’s Shopify accounting automation solves this by letting you configure separate Chart of Accounts mappings per bank account, ensuring that each payout is posted to the correct account in your accounting software (e.g., QuickBooks Online, Xero, Sage Intacct).

The Problem: One Store, Multiple Payout Accounts

Shopify allows merchants to receive payouts into different bank accounts — common in cases like:

- Multi-location or multi-entity businesses

- Country-specific payout accounts

Bookkeep’s Solution: Bank-Specific Mapping

With Bookkeep, you can assign distinct chart of accounts mappings for each Shopify payout account you use.

How it works

- Bookkeep detects the bank account receiving each Shopify payout.

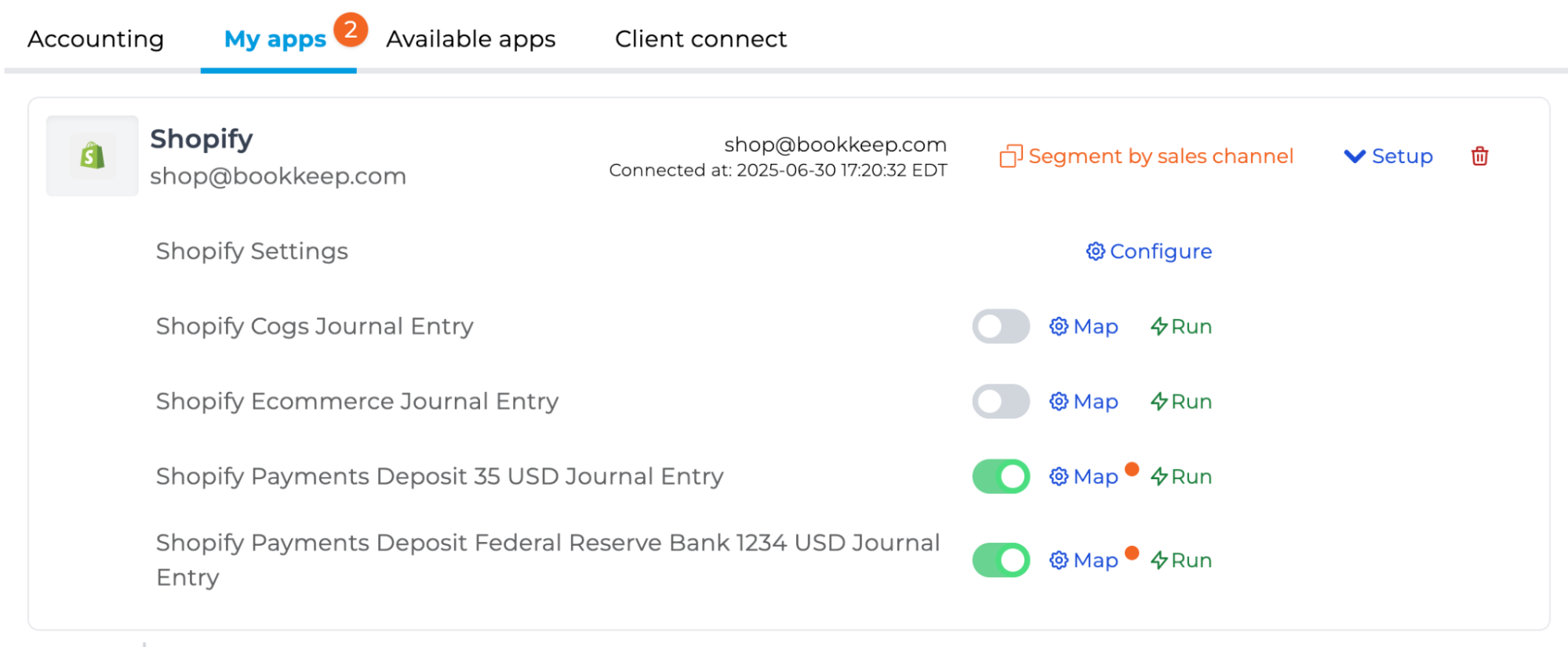

- Each bank account is linked to its own accounting mapping as shown below:

- Each payout from Shopify is then posted to the correct accounts.

- No manual reclassification or journal edits needed in your accounting platform.

Benefits

- No manual journal adjustments

- Accurate multi-bank reconciliation

- Faster month-end close

How to Set It Up

If you're using multiple bank accounts for Shopify payouts, Bookkeep’s automation will detect any bank accounts used and create bank-specific mappings for your account. No effort is required to enable this beyond completing the chart of accounts mappings.

Summary

Bookkeep’s Shopify integration doesn’t just automate sales entries — it ensures that each payout lands in the right place, with a correct chart of accounts mapping based on the destination bank account. That means cleaner books, less manual work, and accurate reporting you can trust.

Need help configuring this? Contact our support team at support@bookkeep.com.