Automating Duty Accounting for Shopify Managed Markets with Bookkeep

Introduction

Selling internationally via Shopify Managed Markets involves collecting duties from customers, which Shopify often withholds from payouts to remit to customs authorities. Bookkeep's automated accounting solution streamlines this process by accurately capturing both the duty collection and withholding in the appropriate journal entries, saving accountants significant time and reducing the risk of errors.

The Challenge of Duty Accounting with Shopify Managed Markets

International sales through Shopify Managed Markets involves several accounting challenges:

- Duties collected from customers must be properly recognized

- Shopify commonly withholds these duties from merchant payouts to remit to the appropriate authorities

- Multiple journal entries are required to accurately reflect these transactions

- Manual reconciliation is time-consuming and error-prone

- Accounting systems and chart of accounts must be properly configured

How Bookkeep Automates Duty Accounting

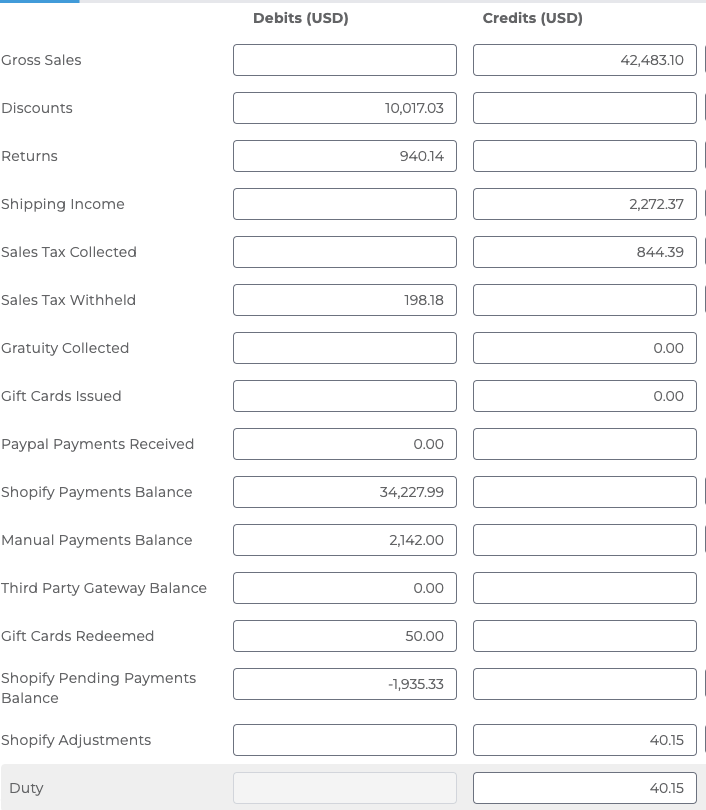

1. Sales Summary Journal Entry: Capturing Duties Collected

When a Shopify order with duties is processed, Bookkeep automatically:

- Records the collected duty amount daily under the 'Duty' subcategory in the Adjustments line of the ecommerce journal entry.

- Separates duties from other order components like product revenue, shipping, and taxes

- Maintains detailed records of duty amounts by order in the attachment of the journal entry

Example Sales Journal Entry:

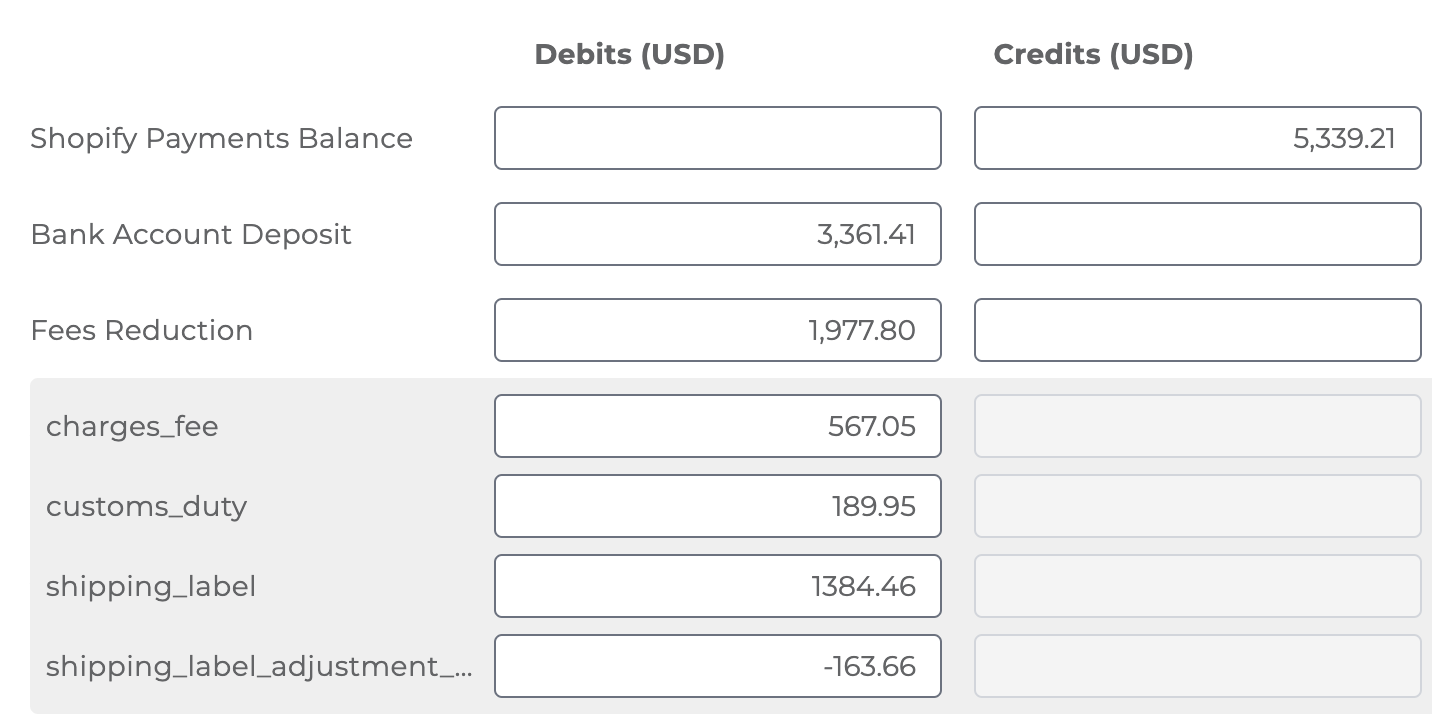

2. Deposit Journal Entry: Reflecting Duty Withholding

When Shopify processes a payout, they commonly withhold the duty amount to remit to customs authorities. Bookkeep accurately represents this by:

- Capturing as a subcategory called “Duty” or “customs duty” under the Fees Reduction line of the deposit journal entry

- Providing detailed reporting on duties withheld in the attachments to each deposit journal entry

Example Deposit Journal Entry:

Benefits for Accountants and Bookkeepers

Bookkeep's automated duty accounting provides several key benefits:

Time Savings

- Eliminates manual data entry: No need to manually calculate or enter duty amounts

- Reduced month-end closing time: Accurate journal entries are created daily without manual intervention

Accuracy Improvements

- Consistent classification: Duties are consistently recorded in the correct accounts

- Reduced risk of errors: Automation eliminates human error in calculation and entry

- Detailed audit trail: Complete history of duty collection and withholding is maintained

Implementation Best Practices

To fully leverage Bookkeep's automated duty accounting, consider the following best practices:

- Set up appropriate accounts: Create dedicated liability accounts for duty collection

- Configure mapping: Properly map Shopify duty fields to the correct accounts in Bookkeep

- Review setup: Verify initial transactions to ensure proper classification

- Monitor regularly: Check duty account balances periodically to ensure ongoing accuracy

Conclusion

Bookkeep's automated accounting for Shopify Managed Market duties transforms a complex, time-consuming process into a streamlined, accurate workflow. By correctly capturing both the collection and withholding of duties, Bookkeep eliminates hours of manual work while improving the accuracy of financial records. This automation allows accountants and bookkeepers to focus on higher-value activities while ensuring duty accounting is handled correctly.

If you have any questions, please reach out to us at support@bookkeep.com.