How Bookkeep Records Shopify Restocking Fees in your Accounting Platform

This article explains how Bookkeep captures and records Shopify restocking fees in your accounting platform.

Understanding Shopify Restocking Fees

According to Shopify, you can add a restocking fee to your returns:

“Choose whether you want to charge a restocking fee that is a percentage of the return. If activated, then a restocking fee is displayed to your customers. The restocking fee is displayed when you create a return. You can edit the restocking fee for a specific return and edit it by item.”

This restocking fee, in essence, is a reduction to the final amount refunded to the customer in a return.

Recording Restocking Fees with Bookkeep

Bookkeep captures these return or restocking fees under the gross sales line on the sales summary journal entry as well as the fulfillment revenue recognition journal entry. This restocking fee will appear as its own subcategory under the gross sales lines in the respective journal entries mentioned above.

First, here is an order displaying the restocking fees in Shopify for $855:

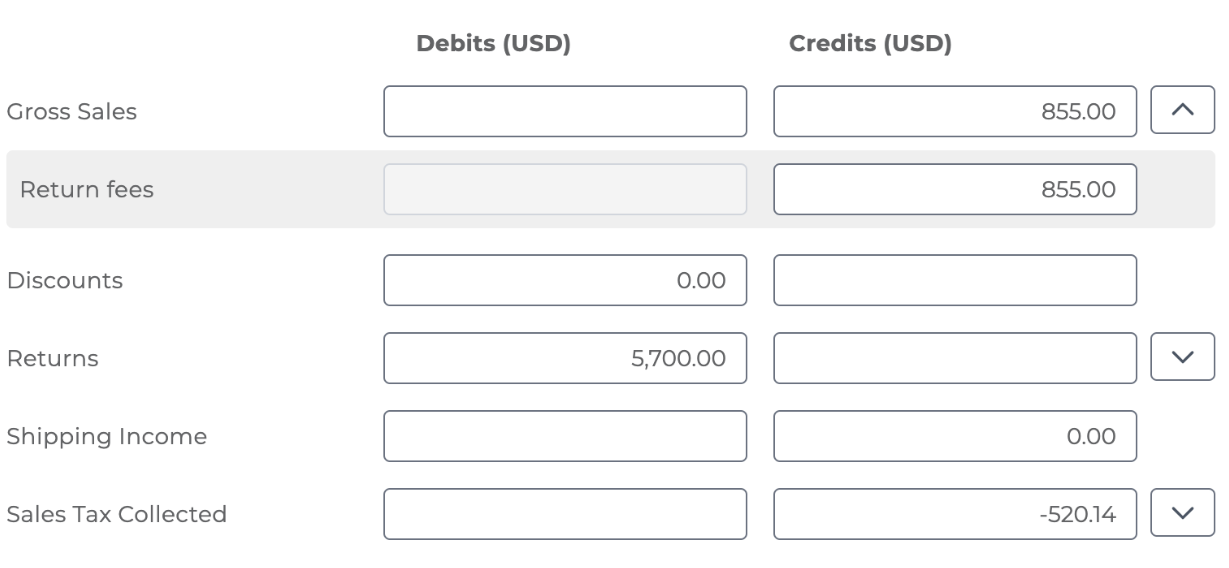

Sales Summary Journal Entry

This return fee is captured on the sales summary as shown below by Bookkeep under the gross sales line since it is an earned fee by the store, reducing the amount returned to the customer:

In the example above, the $5,700 refund is reduced by the $855 returned to the customer.

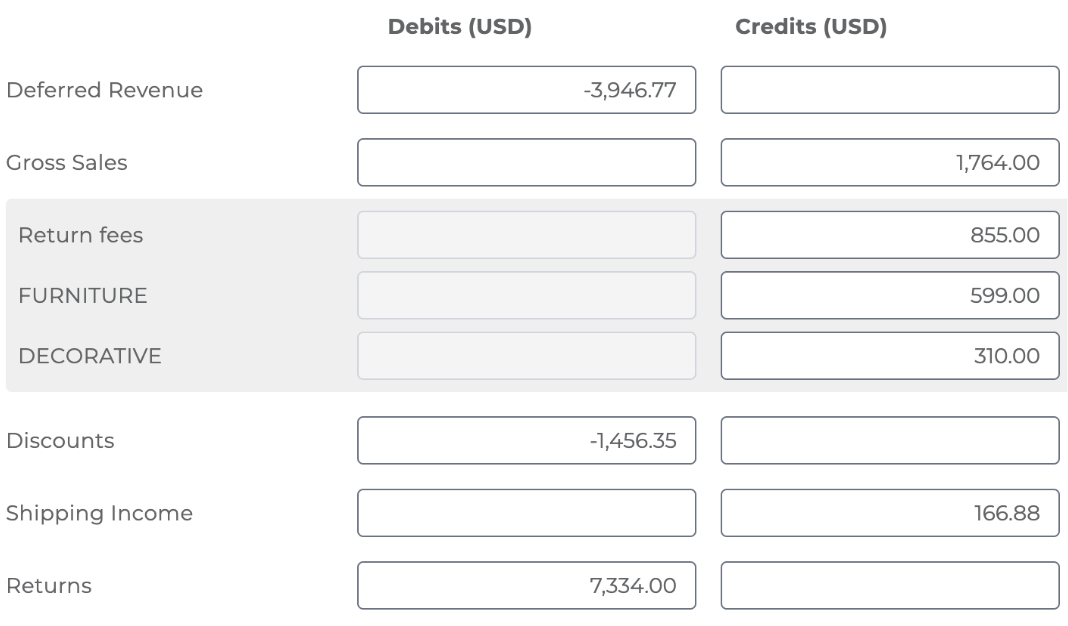

Fulfillment Revenue Recognition Journal Entry

For customers recognizing revenue on a fulfillment basis, the restocking fee also appears under the gross sales line for orders that are completely fulfilled:

Capturing these fees when the order is fully fulfilled for customers who recognize revenue on an accrual basis ensures accurate tracking of both refunds and gross sales.

Bookkeep simplifies and automates the accounting of Shopify restocking fees by accurately separating them as their own subcategory in journal entries. This ensures that restocking fees are properly reflected in gross sales and reduce the amount refunded to customers, giving businesses a clearer picture of earned revenue. By automating this process, Bookkeep eliminates manual tracking errors, streamlines reconciliation with Shopify payouts, and provides accountants and finance teams with precise records for more efficient reporting and compliance.

If you have any questions, please feel free to contact support@bookkeep.com.