Accounting For Shopify Collective Orders

Bookkeep simplifies and automates accounting for Shopify Collective transactions, ensuring accurate financial reporting for both brands and suppliers. Shopify Collective enables a brand to sell products that are fulfilled directly by a supplier—allowing the brand to expand its store inventory without actually carrying the products. While this process is seamless within Shopify, accounting for the related costs and reimbursements can be complex. Bookkeep automates this entirely, eliminating the need for manual bookkeeping.

/

How Shopify Collective Orders Work

-

Order Placement

-

A customer places an order through the brand’s Shopify store.

-

From the brand’s perspective, this functions like a normal order and appears as such in sales summaries. For example, if the order is paid via Shopify Payments, it will show up in a standard payout just like any other order.

-

-

Supplier Fulfillment

-

The supplier fulfills the order.

-

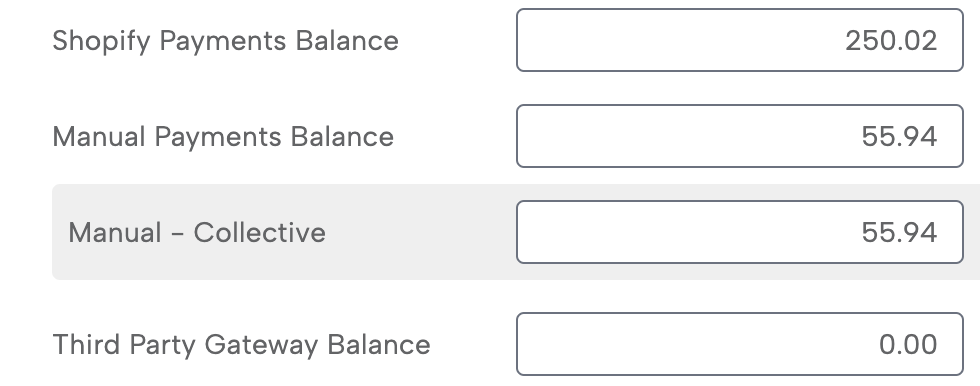

On the supplier’s side, Shopify automatically creates an order linked to the Shopify Collective sales channel, typically marked as a manual payment. When Bookkeep detects a manual payment, it checks whether the order is a Collective order. If it is, Bookkeep relabels it as “Manual – Collective” to make it easier to track and reconcile these transactions. This distinction helps clarify accounting since manual payments don’t normally flow through the Shopify Payments balance, even though the related funds often appear in a standard Shopify payout.

-

Financial Flows

Brand Accounting

-

Once the supplier fulfills the item, the brand will commonly see a Shopify Collective debit in their payout.

-

This debit represents an expense to the brand, as it serves as a reimbursement to the supplier for the cost of goods sold (COGS).

-

Bookkeep automatically records this with the “Shopify Collective debit” label on the Shopify payout entry, so you do not need to manually book it.

Supplier Accounting

-

After fulfillment, the debit on the brand side occurs in parallel with a Shopify Collective credit in the supplier’s payout.

-

This credit represents the supplier’s accounts receivable payment, corresponding to the manual payment balance recorded on the sales summary mentioned above.

-

There may be a timing difference between the sales recognition on the supplier’s books and the appearance of this credit in Shopify payouts.

Example Journal Entries:

1. Brand Journal Entries

Scenario:

-

A customer buys a product for $100.

-

The supplier’s cost of goods sold (COGS) is $60.

-

Shopify Collective will reimburse the supplier from the brand’s payout.

Journal Entry for Brand's Sales Recognition:

| Account | Debit | Credit |

|---|---|---|

| Shopify Payments Balance | $100 | |

| Gross Sales | $100 |

Journal Entry for Brand's Reimbursement to Supplier (via Deposit entry)

| Account | Debit | Credit |

|---|---|---|

| Shopify Collective Debit (e.g. COGS to the brand) | $60 | |

| Shopify Payments Balance | $60 |

2. Supplier Journal Entries

Scenario:

- Supplier fulfills the order and receives reimbursement from the brand ($60).

Journal Entry for Supplier's Sales Recognition:

| Account | Debit | Credit |

|---|---|---|

| Manual Payments - Collective (Accounts Receivable to the Supplier) | $60 | |

| Gross Sales | $60 |

Journal Entry when Payment is Received (via Supplier's Deposit entry):

| Account | Debit | Credit |

|---|---|---|

| Bank Account | $60 | |

| Shopify Collective Credit (Payment of Accounts Receivable) | $60 |

How Bookkeep Automates the Process

Bookkeep ensures that all aspects of Shopify Collective accounting are automated:

-

Automatically records sales recognition for both the brand and the supplier.

-

Automatically books the brand’s debits for supplier reimbursements in their payouts.

-

Automatically records credits in the supplier’s payouts representing the payment from the brand.

With Bookkeep, brands and suppliers no longer need to track Shopify Collective transactions manually, reducing errors and saving time while ensuring accurate, reliable accounting.