Square Deposit Day Breakdown

Understanding Square Deposits

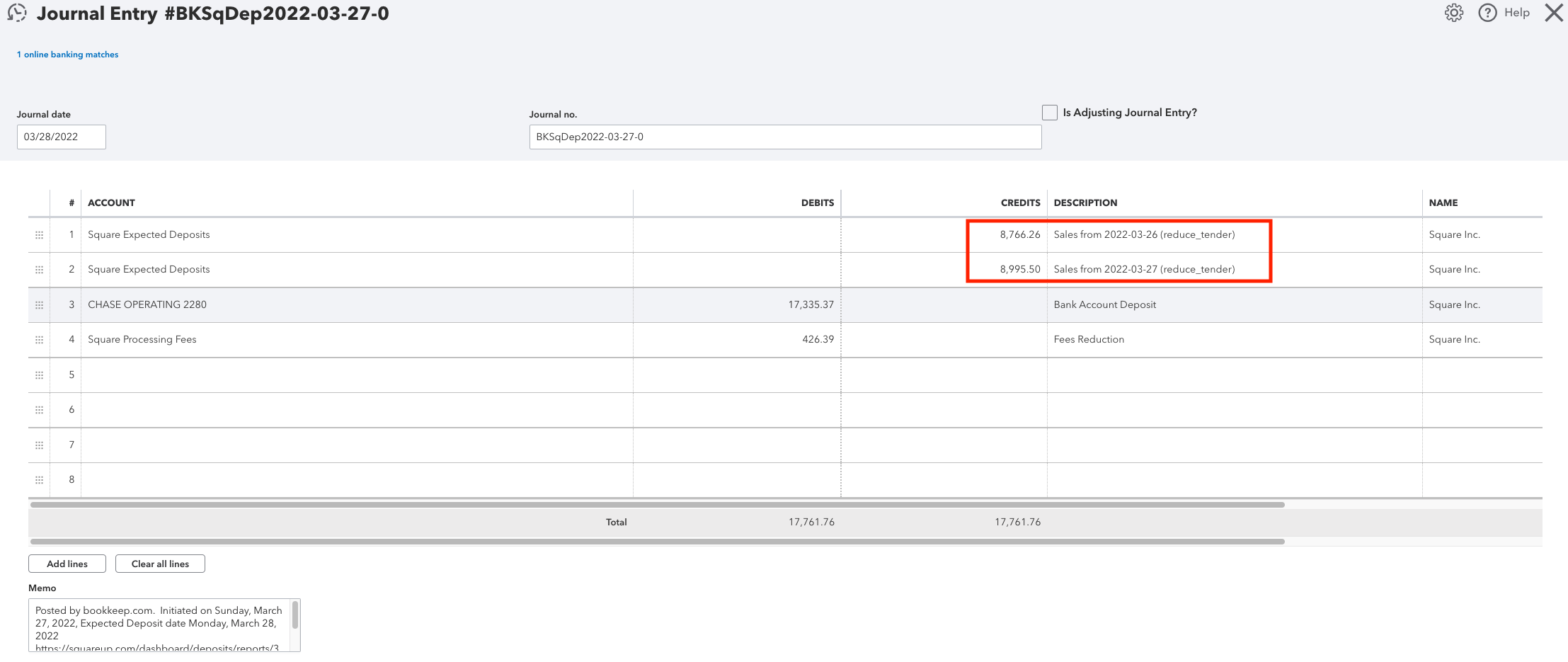

For Square deposits, a decrease in your Square Balance occurs when your bank account receives a payout from Square. Depending on the frequency of your payouts, these might cover multiple sales days. When we post these deposits, we can break down the reduction in the balance by sales day, which is helpful in reconciling your books. This reduction in Square Balance is shown as a separate line in the journal entry representing each sales day impacted.

Example Breakdown

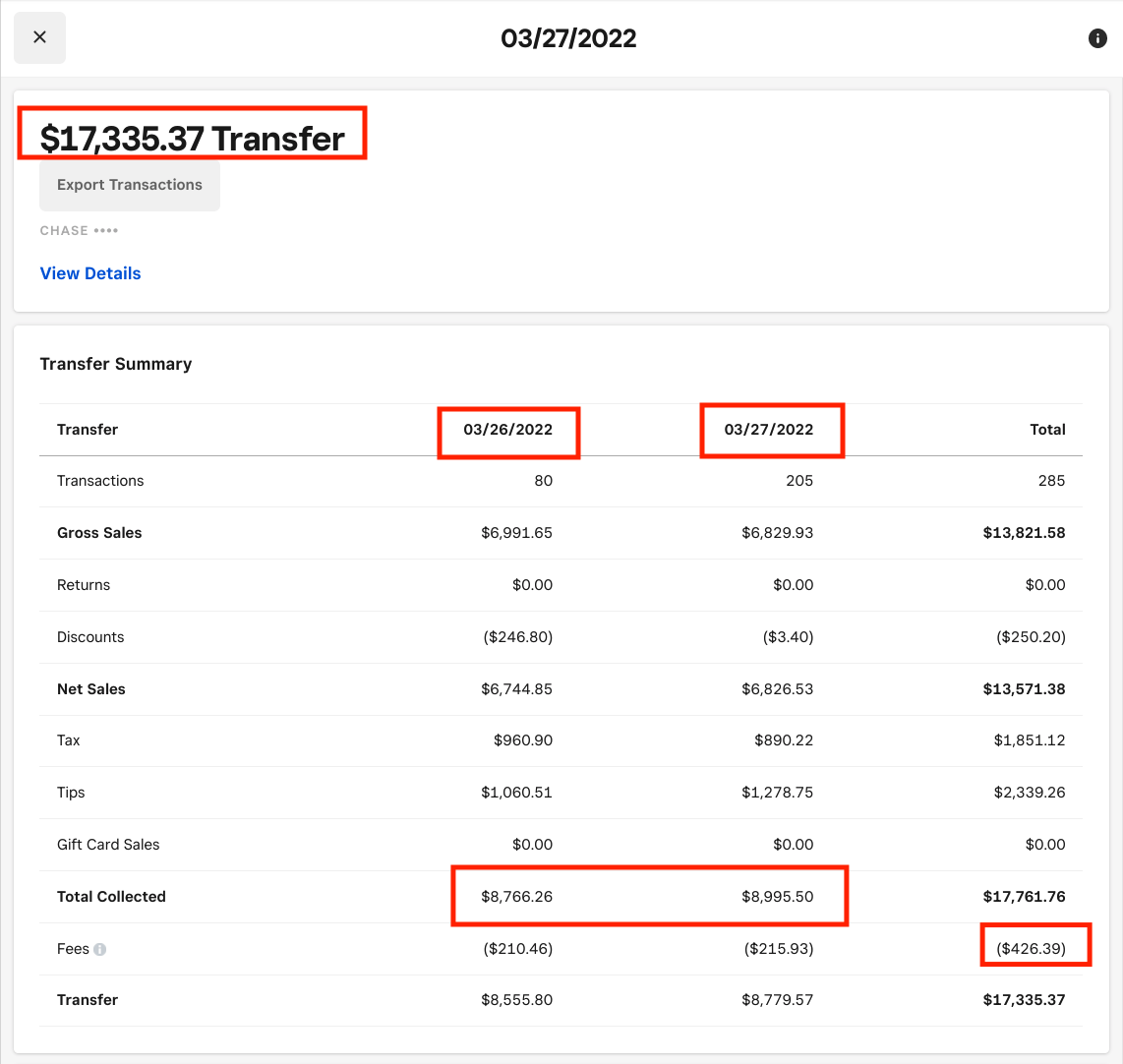

In the example above, the checking account receives $17,335.37 after fees. However, the reduction of Square Balance is related to two days of sales. The 3/26 and 3/27 sales days are both credit amounts representing a decrease in the Square balance as it is being paid out to the bank account. The sum of the two Square balance lines represents the amount being paid out to the bank account before fees. In summary, this breakdown by sales day gives more clarity as to what the deposit represents to help with reconciliation.

Payout Report

For reference, you can see below the corresponding payout report from Square which details the breakdown we capture in our journal entry.

In the journal entry we post to your accounting platform, we also provide a URL in the memo section that you can copy and paste into your web browser, which will direct you to the payout report in Square (as long as you are logged in with the correct credentials).

If you have any questions regarding our Square integration, feel free to write to support@bookkeep.com.