Square Accounting Automation by Bookkeep

Square is a versatile tool that caters to various financial needs such as digital payments, point-of-sale transactions, banking services, and eCommerce solutions. Bookkeep offers a convenient solution for Square merchants by automating the accounting process for financial data through our Square Summary and Square Deposit journal entry templates.

With Bookkeep's support, business owners can navigate the complexities of Square financial data management effortlessly. By leveraging the automation and organization provided by Bookkeep's journal entries described in this article, users can streamline their accounting processes and focus on growing their business.

Square Summary

The Square summary feature automatically records the sales made on the previous day. Bookkeep creates a sales entry for each day in each currency, breaking down the payments by method to help you track your balances by payment type.

Bookkeep can now show refunds to a gift card when the original payment method was not via gift card. Though this data was not previously available through the data from Square, we offer this feature to enable better tracking of gift cards.

- Gross Sales: Credit representing gross revenue before discounts; maps to an income account.

- Discounts: Debit representing order discounts; maps to an income account.

- Refunds: Debit transactions for returned products; maps to an income account.

- Gift Cards Issued: Credit for gift cards sold; maps to a Liability account.

- Sales Tax Collected: Credit for sales tax collected on transactions.

- Gratuity Collected: Credit for tips collected; maps to a liability account or expense account if using Square Payroll.

- Square Balance: Debit clearing account for total collected from credit cards before fees; maps to your Square clearing account. If you don't have a balance account for this line, you should create a new account for better tracking.

- Square Cash Balance: Debit for total collected from cash; maps to a cash clearing account.

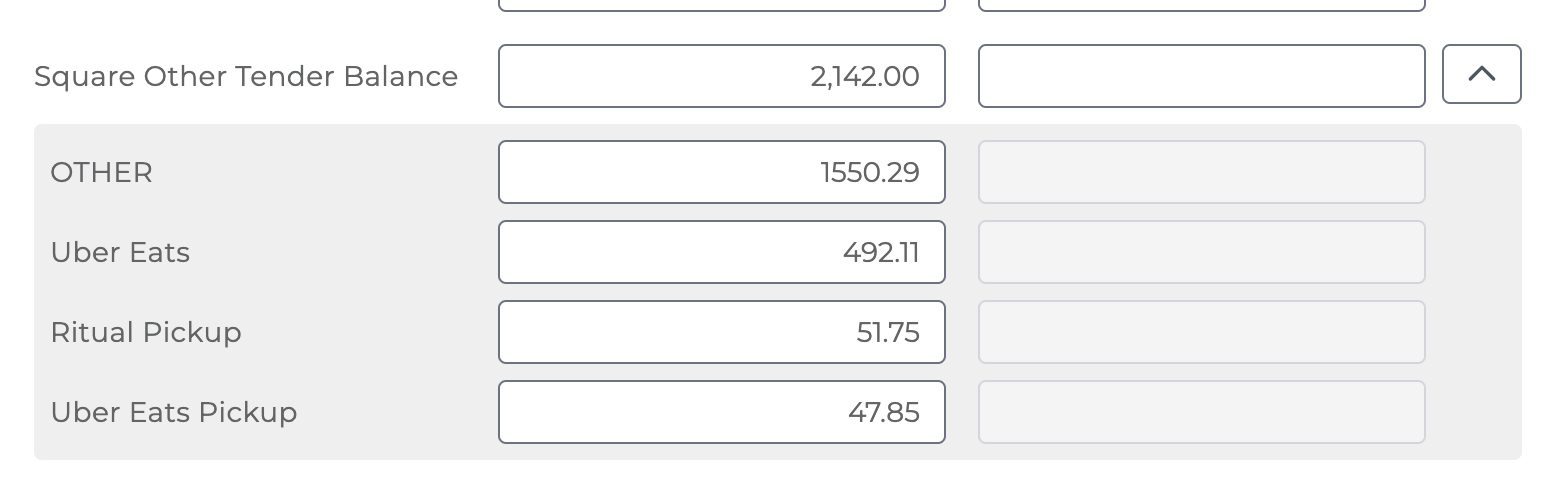

- Square Other Tender Balance: Debit for total collected from other tender types (e.g., checks, bank transfers); maps to another current asset account. We recommend a separate account per payment type so you can ensure you are receiving all payments.

Bookkeep is able to break out the Other Tender line by order source when it is

available from Square. For example, some merchants have order data flowing from

UberEats into Square. Bookkeep is able to break out this data based on the order

source as shown below:

- Gift Tender Total: Total gift cards used as tender. Map to the same account as Gift Cards Issued.

- Partial Payment Deferred Revenue: Captures any partial payments as liabilities for Square Invoices; maps to a clearing account.

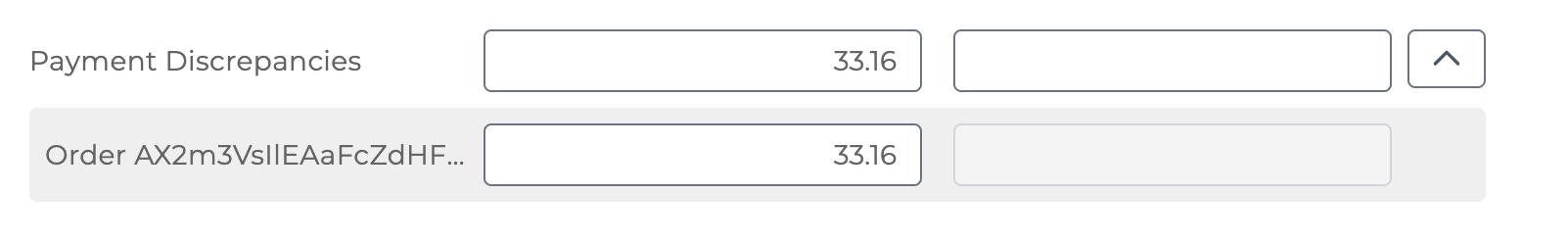

- Payment Discrepancies: Posts orders with failed or no payments under this

line with the order ID to ensure that you are aware of any orders on which payment

was not collected. See image below for an example:

Square Deposit

The Square deposit feature tracks all incoming deposits to your bank account daily. Each deposit made to your bank account reduces your Square balance, and Bookkeep captures this transaction in the journal entry. This entry includes any fees related to sales processing by Square, along with other adjustments and repayments of Square loans.

-

Square Balance: Expected amount from Square before fees and loans; maps to the same Square Balance account from the Square Summary journal entry.

-

Bank Account Deposit: The bank account set up in Square to receive your deposits; maps to the same checking account as in Square.

-

Fees Reduction: Captures Square processing fees; maps to a Cost of Goods Sold or expense account.

-

Loan Payment Reduction: Payments for loans from Square; maps to the Other Current Liability account for your Square Capital Payment.

-

Other Deposit Withheld: Captures various adjustments including Square Instant Deposit Fees and gift card load fees (commonly labeled as "Other" by Square).

Square does not publicly share transactions for Square savings and checking accounts. Bookkeep is unable to capture transactions from these savings and checking accounts as a result. However, we are working with Square to bring these transactions into Bookkeep.

If you have any questions regarding our Square accounting automation, feel free to contact support@bookkeep.com.