Automating Toast MCA Repayments In Bookkeep

Overview

When you connect your Toast account to Bookkeep, your daily sales entries may include MCA Repayments. These amounts can represent several different types of adjustments in Toast, including:

-

Toast Capital payments – repayments toward a Toast Merchant Cash Advance

-

Marketplace Facilitator Tax – taxes collected and remitted by Toast on your behalf

-

Toast Delivery Services costs – fees associated with Toast delivery orders

-

Instant Deposit fees – charges for receiving funds instantly

Because Toast does not currently provide detailed categorization for these adjustments, Bookkeep assigns all such items the label “MCA Repayment.”

How Bookkeep Handles Toast MCA Repayments

Bookkeep automatically processes Toast MCA Repayments as part of your daily sync. Specifically, Bookkeep:

-

Extracts daily sales data from Toast, including all items labeled as MCA Repayments

-

Posts journal entries that record MCA Repayments under the Adjustments line

-

Reduces the Toast clearing account by the MCA Repayment amount, accurately reflecting the reduction in your Toast balance

Example Journal Entry

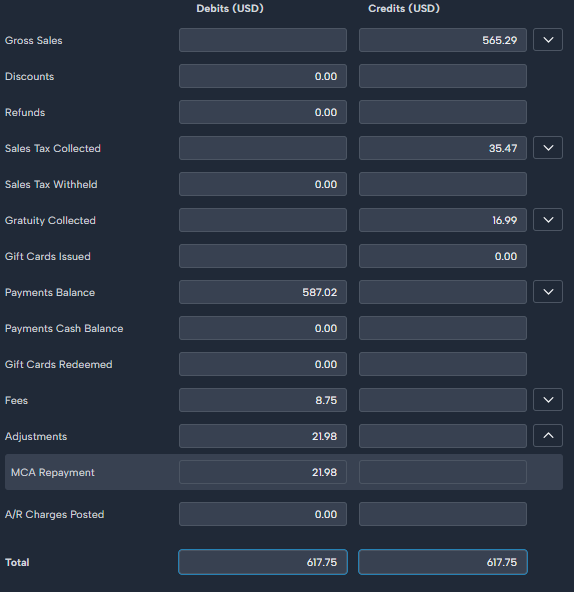

Here’s an example of how an MCA Repayment appears in your daily Toast sales entry:

After accounting for the MCA Repayment of $21.98, the expected Toast clearing account balance is adjusted downward to $587.02, ensuring your books match your actual Toast balance.

Best Practices

To keep your Toast and Bookkeep data accurate and aligned:

-

Keep your Toast integration active and syncing daily to ensure all sales and adjustments are captured.

-

Review your Chart of Accounts mapping to confirm that all adjustment types, including MCA Repayments, are assigned to the correct accounts.

-

Verify any MCA Repayments you see—these may represent loan repayments or other types of adjustments and should be reviewed periodically.

-

Reconcile regularly by comparing Bookkeep’s Toast Summary Journal with the Toast Finance Summary report.

Summary

Bookkeep automatically identifies and records MCA Repayments in Toast as accurately as possible based on the data provided. In addition, Bookkeep monitors each sales tax line to identify any amounts withheld for taxes.

We’re actively working with Toast to provide more detailed categorization of these adjustment types. This ongoing improvement will give you clearer insights into loan repayments, taxes, delivery fees, and instant deposit charges—helping keep your books accurate and reconciled without any manual effort.