How Bookkeep Posts Financial Data to QuickBooks Online

Bookkeep is a powerful tool designed to streamline your financial processes by automating data entry tasks through integration with various platforms. Bookkeep can effortlessly fetch your financial information and seamlessly transfer it into QuickBooks Online as organized journal entries. This automation not only saves you valuable time but also eliminates the need for manual data input, reducing the risk of errors and ensuring accurate financial records.

To better understand this, let's look at the common journal entry types we post to QuickBooks Online. Depending on the specific integration, e.g., Shopify, Stripe, Square, we offer various journal entries that we can post daily once mapped and enabled.

Let's review common journal entries Bookkeep posts to QuickBooks.

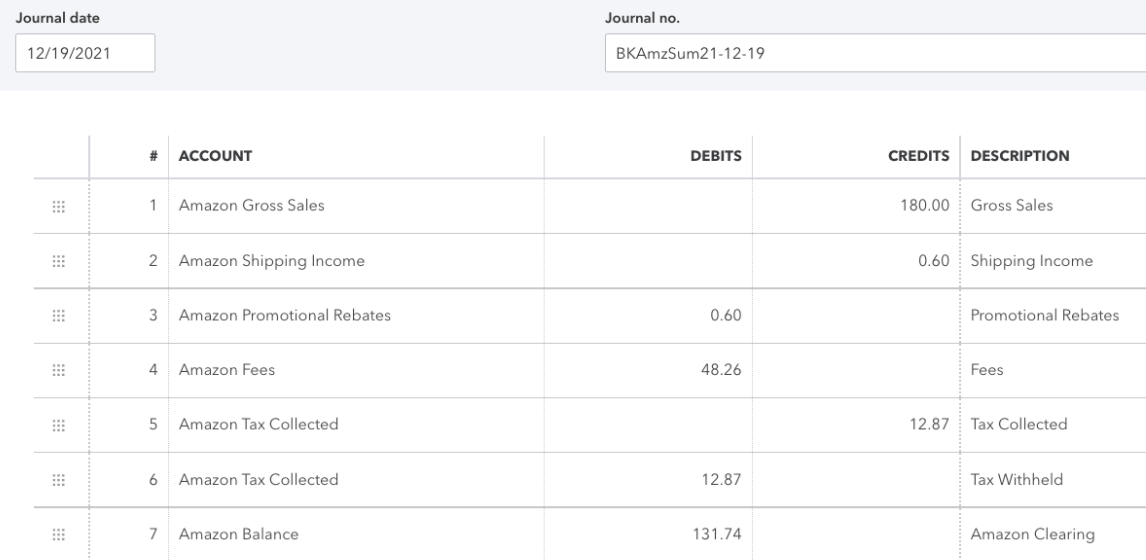

Sales Summary

For daily sales, we post one journal entry per currency per day, summarizing all sales instead of posting each order individually. Below is an example of such a journal entry.

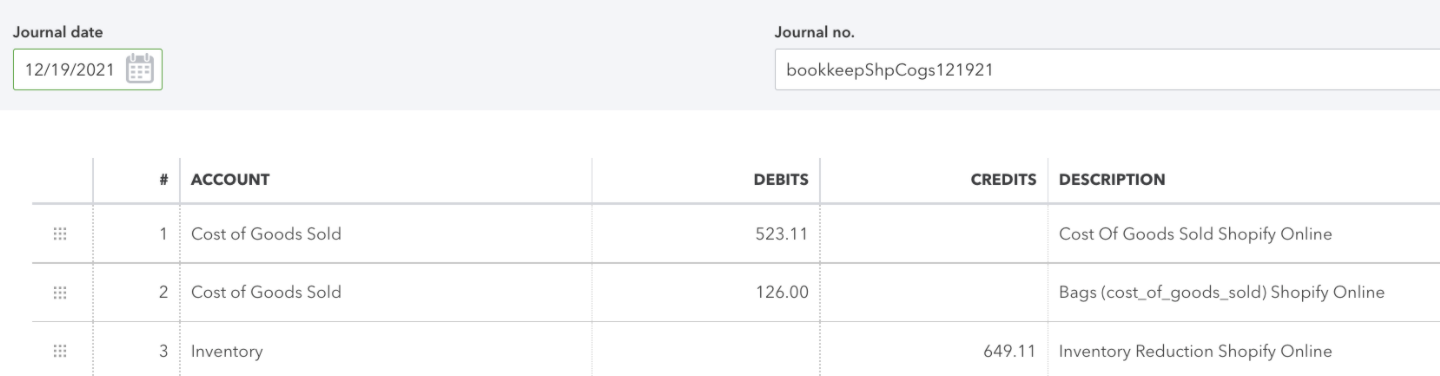

Cost of Goods Sold (COGS)

The COGS entry represents the cost of goods sold for the entire day, increasing the cost of goods account and decreasing inventory. Like sales, this is summarized in one daily journal entry.

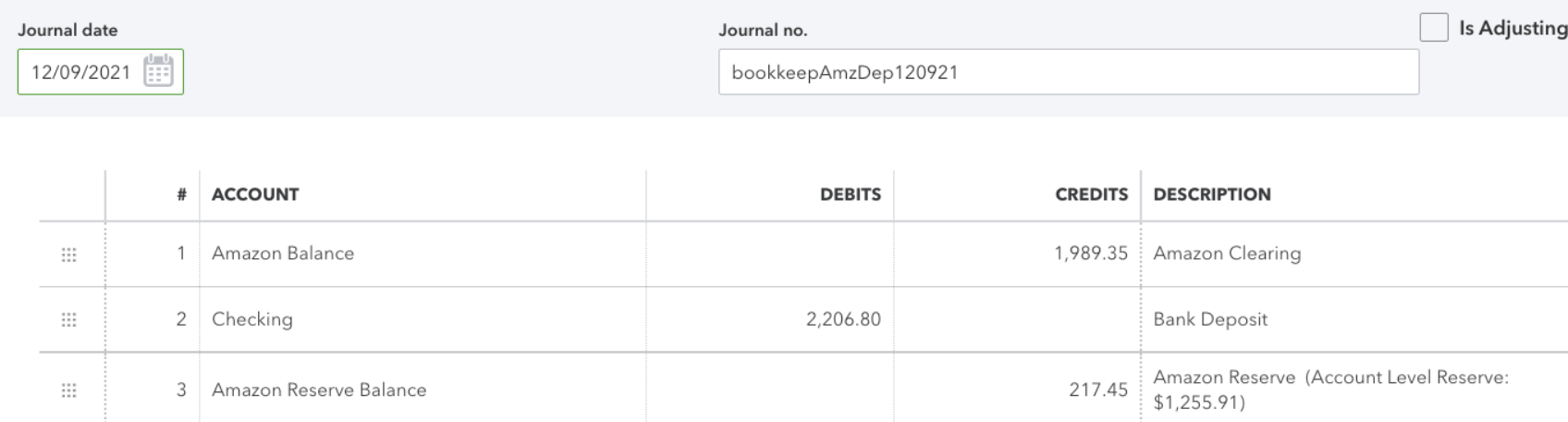

Bank Deposits or Payouts

Bookkeep posts each bank deposit separately to facilitate easy matching with your bank statements or bank feeds.

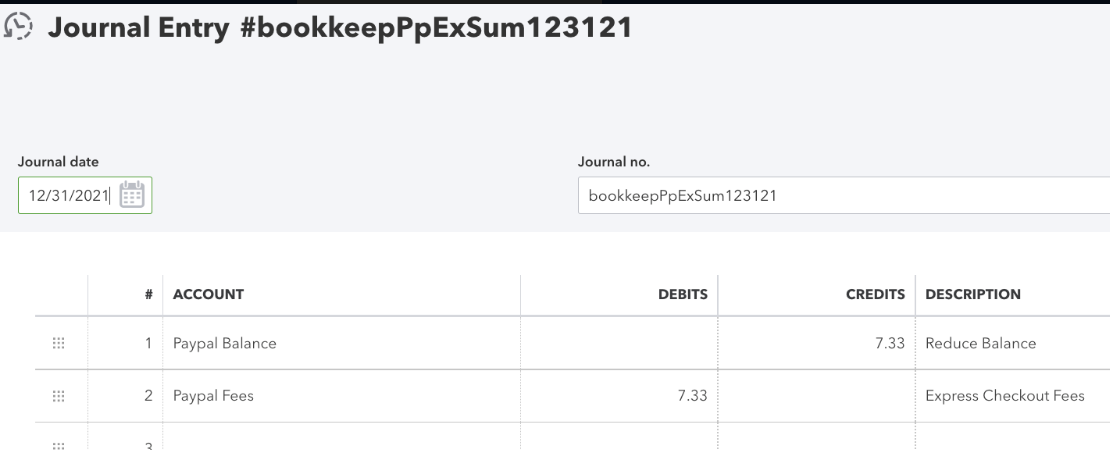

Fees

Fees are posted as one summarized journal entry per day, covering common transactions like payment processing fees. For instance, if PayPal processes sales for a Shopify store, the fees incurred from PayPal would be captured in this journal entry.

Contact support@bookkeep.com if you have any questions.