Mindbody Sales Summary

Bookkeep automatically generates a daily sales summary journal entry for your Mindbody integration.

Each entry captures the prior day’s sales activity, providing a complete accounting snapshot — from gross sales through net sales, including discounts, refunds, gift cards, tips, and payment method breakdowns.

This guide walks you through how to reconcile Bookkeep’s automated entry against Mindbody reports, ensuring everything ties out cleanly in your books.

Note: Mindbody does not provide the processing fees for payment processors.

Overview

Bookkeep’s Mindbody integration automates your daily revenue recognition process by syncing key sales data to your accounting platform (e.g., QuickBooks Online, Xero, Sage Intacct).

Each journal entry will typically include:

-

Sales by category

-

Discounts and refunds

-

Tips and gratuities

-

Gift cards issued and redeemed

-

Payments by tender type

-

Accounts receivable (Payments on Account)

This process mirrors the Mindbody Daily Closeout Report, which serves as your source-of-truth for daily reconciliation.

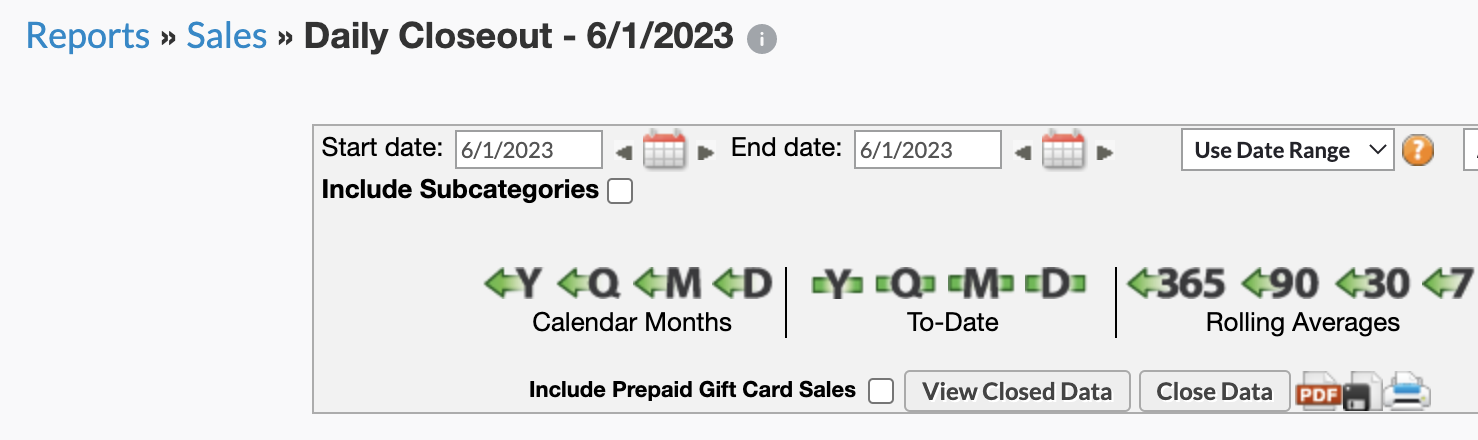

Step 1: Retrieve the Daily Closeout Report

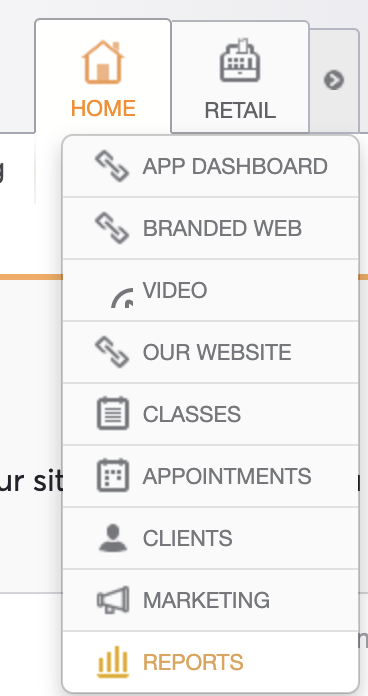

Bookkeep best aligns with the Daily Closeout report that can be retrieved from Mindbody for a specific day under Reports from the Mindbody top navigation.

Daily closeout is under sales reports:

Step 2: Include Gift Cards Report

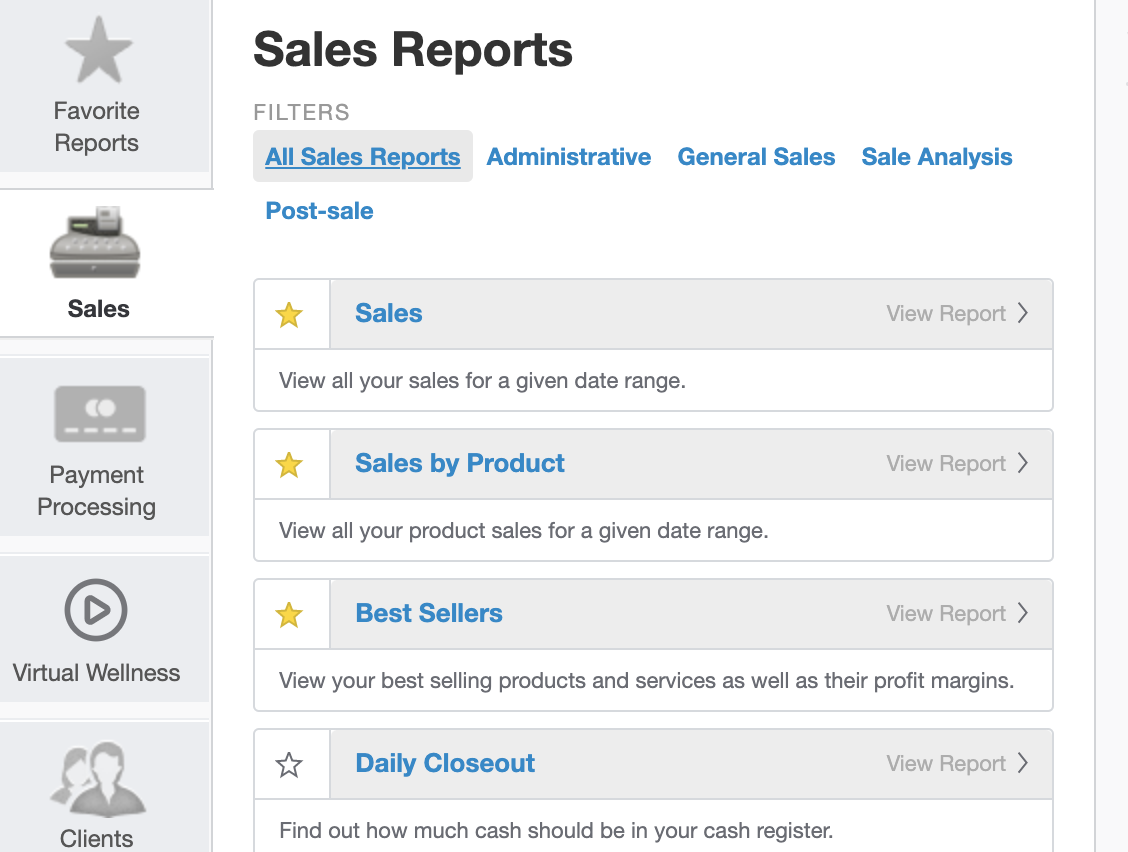

The Daily Closeout report does not include gift cards issued. You must fetch the gift cards report also under the sales section:

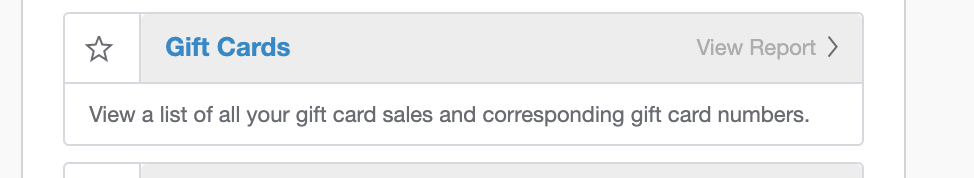

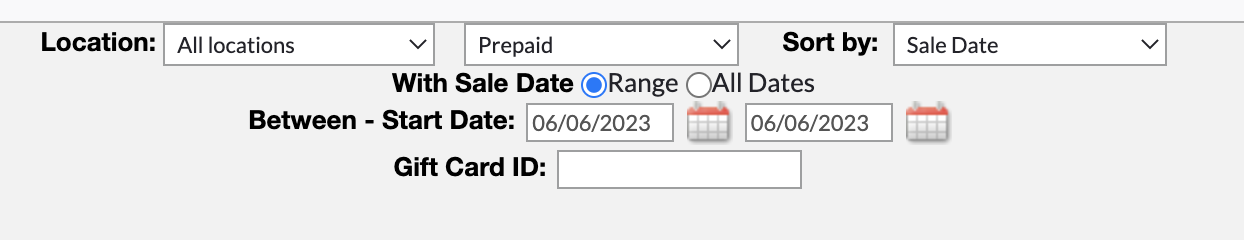

Select prepaid gift cards and filter to the day and location:

Negative amounts in the gift card report indicate redeemed gift cards, and positive amounts indicate issued gift cards.

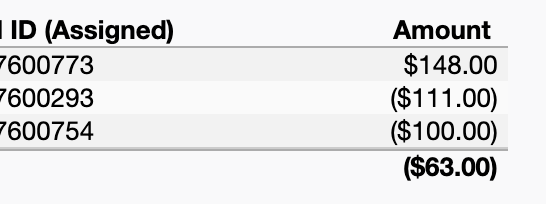

In the example below, we have fetched the gift card report:

Example:

For 6/1/23, the Gift Card Report shows:

-

$148.00 issued

-

$211.00 redeemed

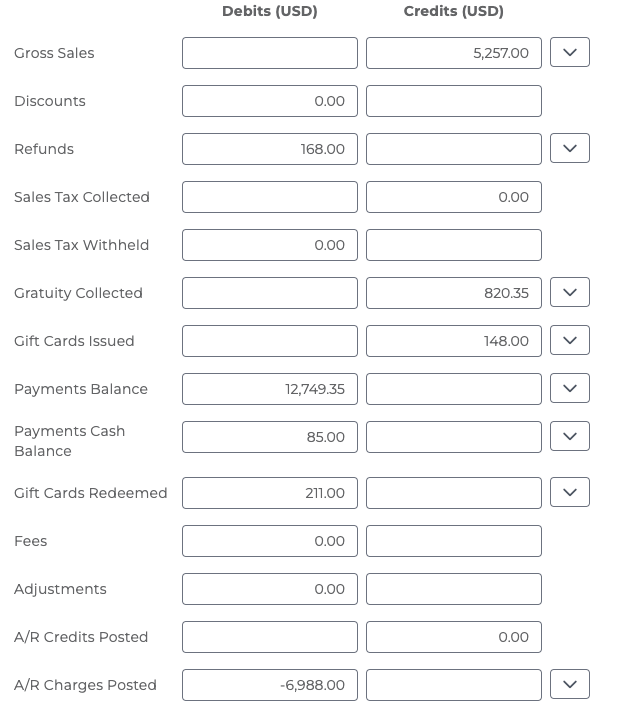

Step 3: Review the Bookkeep Journal Entry

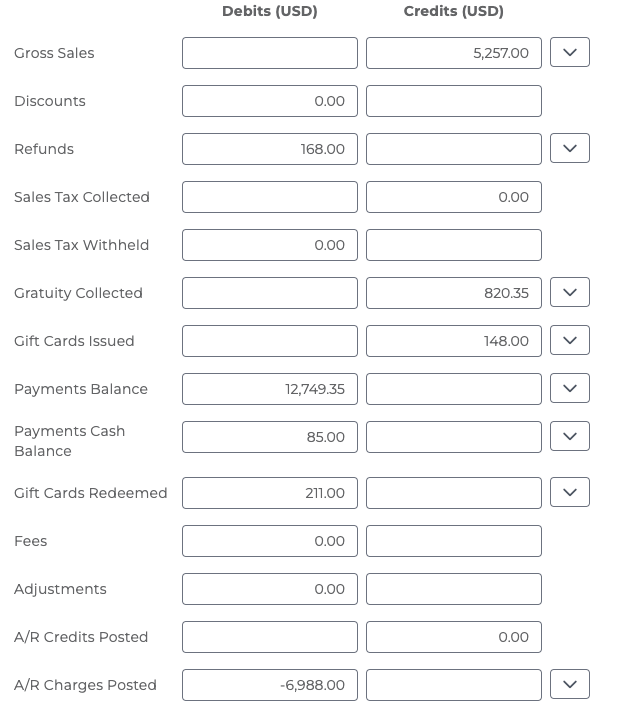

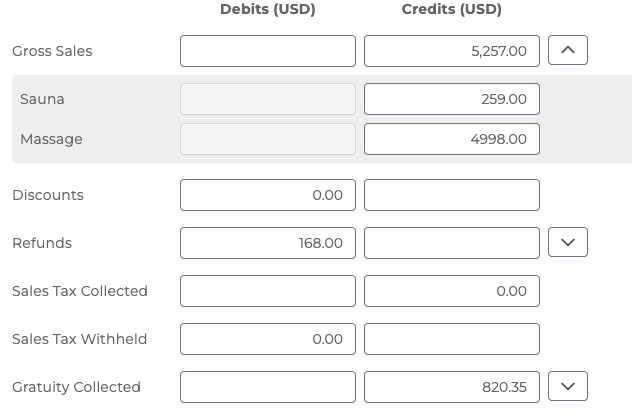

In this example, we are reviewing 6/1/23, and below shows what Bookkeep posted:

Bookkeep automatically posts your daily sales summary.

This entry includes all relevant balances — Sales, Discounts, Tips, Refunds, Gift Cards, and Payments — summarized by type. Mindbody does not provide processing fees.

Step 4: Fetch Daily Closeout Report

Fetch the daily closeout report in Mindbody as shown here:

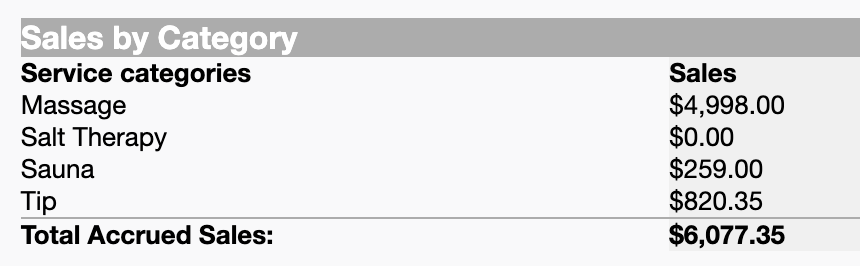

Step 5: Reconcile Sales and Discounts

Mindbody displays sales after discounts in the closeout report.

To tie out to Bookkeep, subtract discounts from gross sales per category.

Mindbody:

Bookkeep:

On this date, there were no discounts, so no subtraction was necessary.

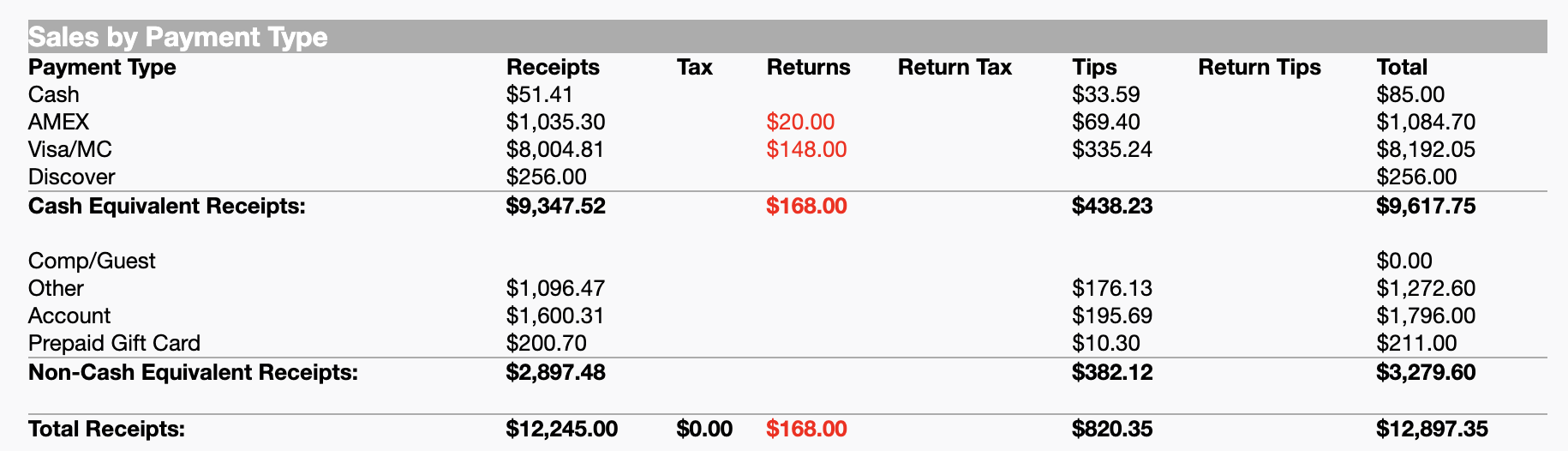

Step 6: Reconcile Refunds, Tips, and Payments

Next, tie out the refunds, gratuity/tips, and payments.

Mindbody:

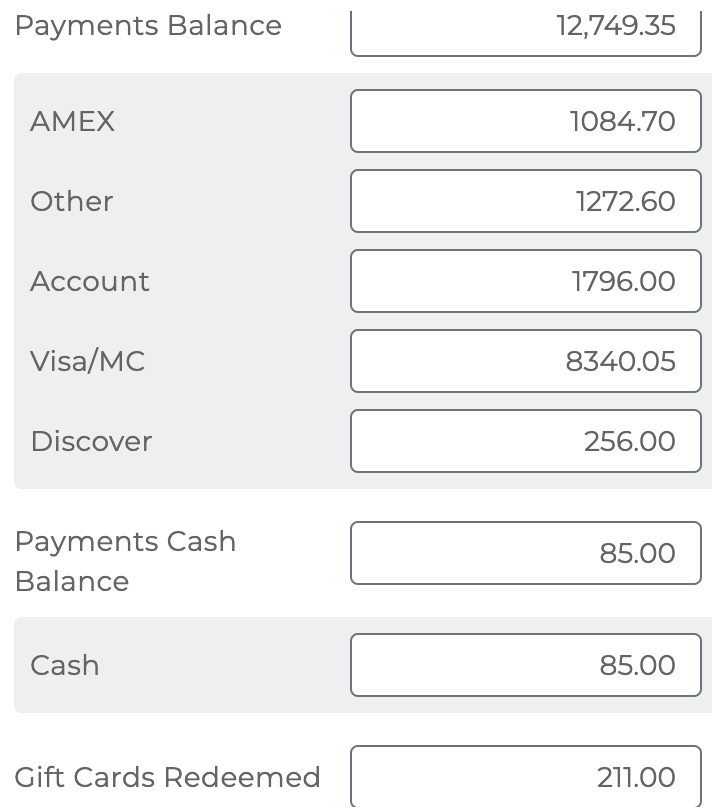

The tips total of $820.35 matches what Bookkeep posted (visible in the image above). The $168.00 of total returns in the Mindbody report matches what Bookkeep posted (also in the image above). The total column on the right per payment type matches what Bookkeep posted as shown below.

Note: Mindbody excludes gift cards issued from the payment totals. For Visa/MC, Bookkeep shows $8,340.05, while Mindbody shows $8,192.05. This difference of $148.00 represents the gift cards issued.

Step 7: Reconcile Accounts Receivable (“Payments on Account”)

Finally, confirm that Accounts Receivable (called Payments on Account in Mindbody) matches what Bookkeep posted under the A/R charges posted line below.

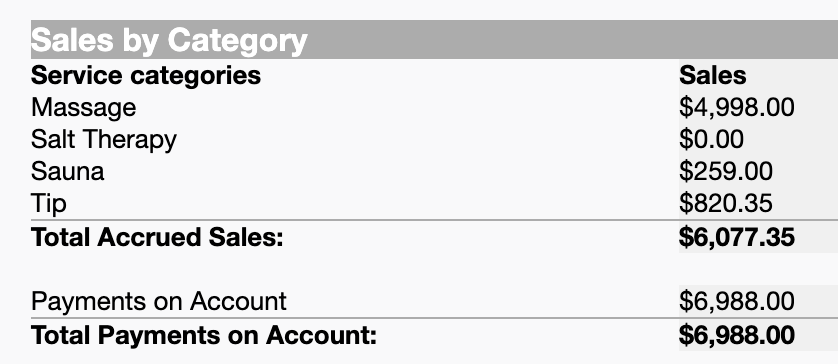

You’ll find this value in Mindbody under Sales by Category → Payments on Account:

Need Help?

If you have questions about reconciling your Mindbody entries or setting up your integration, reach out to support@bookkeep.com.

Our accounting specialists are happy to walk you through your reports and show you how Bookkeep can simplify your Mindbody accounting automation.

Mindbody is supported by Bookkeep Sales Tax.