Grubhub Journal Entries

Bookkeep enables you to integrate your Grubhub account to automate journal entry postings.

The two journal entry postings we automate with Grubhub are:

- Sales Summary

- Deposit

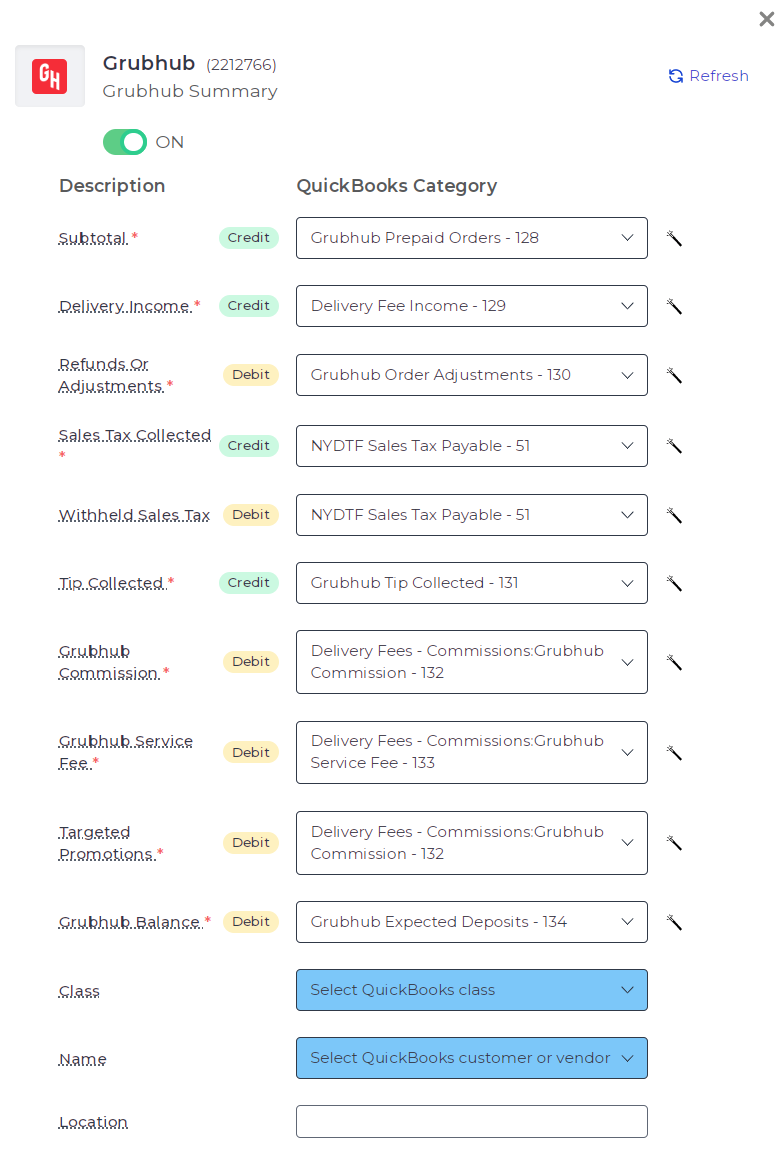

Sales Summary

The Sales Summary journal entry posts to your accounting platform on a daily basis, capturing the sales from the prior day. It includes gross sales down to net sales, encompassing refunds, sales tax, tips, and various fees and commissions from Grubhub.

We capture Sales Tax Collected and Withheld. For some accounts, Grubhub withholds and pays the tax, so we recommend mapping these lines to the same accounts since they should net to zero. For most Grubhub accounts, the seller must pay the tax.

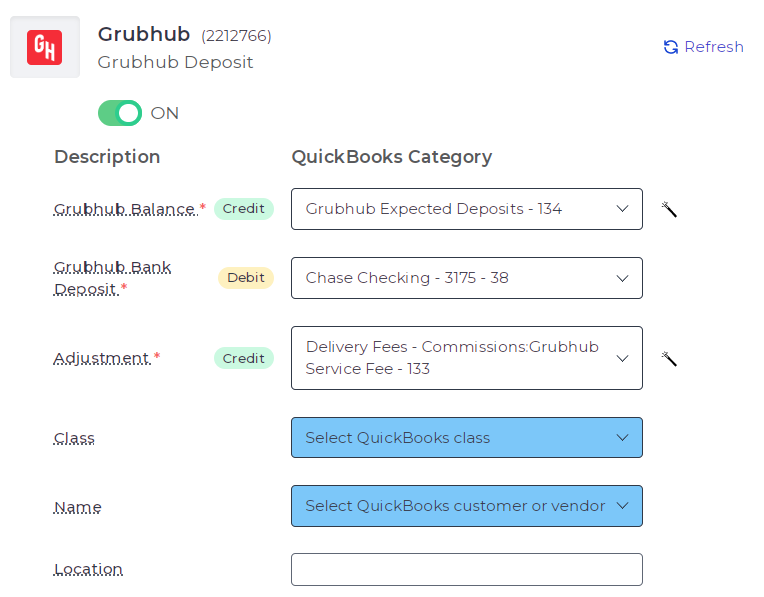

Deposit

The Deposit journal entry captures new deposits to your bank account related to Grubhub sales, as well as any adjustments made to your balance.

Grubhub usually makes weekly payouts for the average accounts (on Wednesdays or end of month).

Any sales processed by Grubhub and captured in the Sales Summary will increase your Grubhub balance. This balance decreases when there is a deposit to your bank account, which is captured in this journal entry.

If you have any questions regarding our Grubhub journal entries, please contact support@bookkeep.com.