How Bookkeep Posts To Netsuite With Sales Tax

Bookkeep offers functionality that allows you to track sales tax by leveraging tax rates within NetSuite.

This feature is supported with our Clover, MindBody, Square, Shopify, SumUp, and Squarespace app integrations.

Mapping in Bookkeep

In Bookkeep, you’ll see categories and subcategories for your sales data, and each one must be mapped to the correct NetSuite tax rate. If any subcategory is missing a tax rate mapping in NetSuite, the posting will likely fail.

After adding new tax rates in NetSuite, be sure to sync or refresh your connection in Bookkeep so it can pull in the latest tax rates for mapping.

You’ll be required to map three components:

1. Clearing account

Bookkeep uses this account to calculate the tax collected and withheld amounts. After taxes are calculated in an entry, any amounts are reversed so the net impact to this account is zero.

2. Tax account

This is the account where the net tax-collected balance will reside.

3. Tax rates

These are the individual tax rates that must be mapped to your Bookkeep subcategories.

Posting Mechanism

Bookkeep takes the net tax collected directly from your point-of-sale or online system (e.g., Shopify, Mindbody, Square) and applies that amount to the related revenue. Bookkeep does not ask NetSuite to calculate the tax; instead, it uses the tax amount already collected and assigns it to the mapped tax rate.

For example, if the tax rate is 20% and your system reports $20 of tax collected, Bookkeep will post $100 to the mapped clearing account with the 20% rate applied, resulting in the $20 tax amount.

In the journal entry that posts to NetSuite:

-

A separate line (or lines) posts the tax collected to the tax payable account, tied to the mapped tax rates.

-

A final line reverses the amount from the clearing account so that the NetSuite tax clearing account nets to zero, while the tax payable is accurately recorded in the designated tax account.

Example Workflow

-

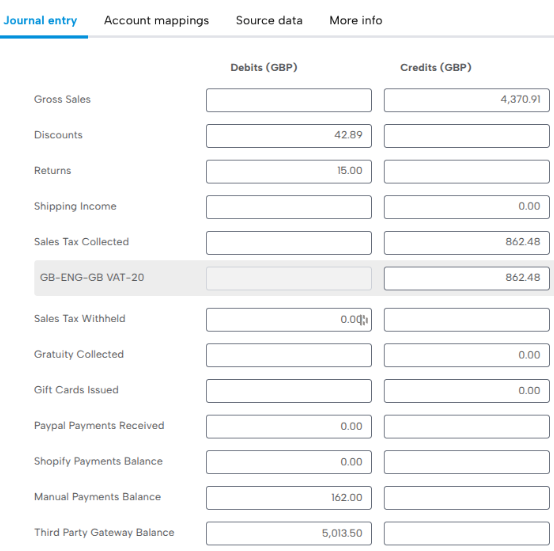

Sales system collects tax (e.g., $862.48 at 20%) as shown below.

-

Bookkeep calculates the taxable revenue amount based on the tax collected and the mapped tax rate.

In this example, $862.48 is collected with a mapped rate of 20%. Dividing $862.48 by 0.20 gives $4,312.40, which is the amount posted to NetSuite.

-

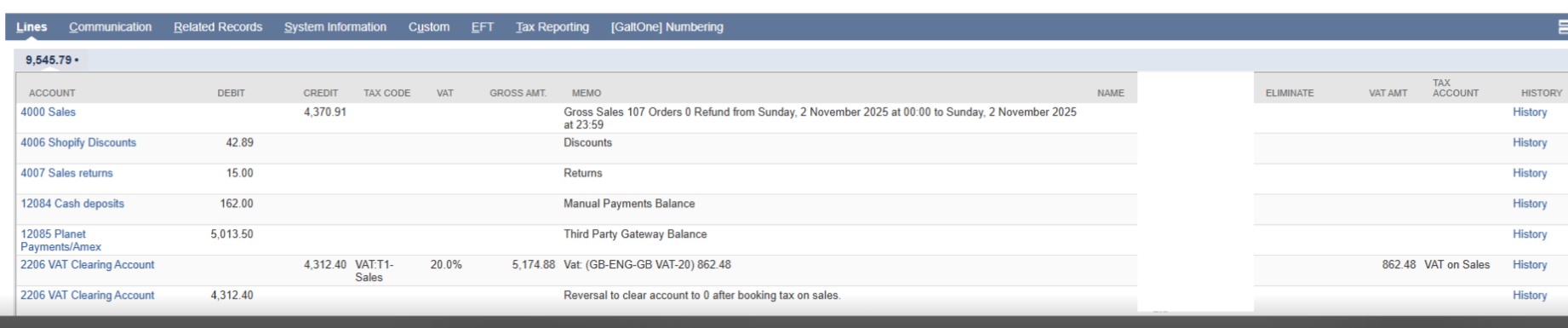

Bookkeep posts to NetSuite as follows:

-

Tax collected recognition line: $4,312.40 (tax-exclusive) is assigned to the mapped clearing account with the 20% rate applied.

-

Tax amount: $862.48 is assigned to the tax code “VAT” with a 20% rate and is posted to the mapped Tax Account.

-

Clearing line: $4,312.40 is reversed from the tax clearing account so it nets to zero. No rate is applied on this line, ensuring the net tax collected remains accurate.

See example below:

NetSuite records the revenue, tax liability, and clearing entries so that your tax reporting and return generation align with the mapped tax codes.

-

Important Note

As always, please consult your accountant and your tax authority to confirm your tax reporting obligations (GST, VAT, sales tax). Bookkeep provides the automation mechanics, but you remain responsible for ensuring compliance.