Single Order Entries vs. Summary Entries

Streamlining Accounting with Summary Journal Entries

When recording data into your accounting system, prioritizing both accuracy and usability is essential for effective financial reporting and decision-making.

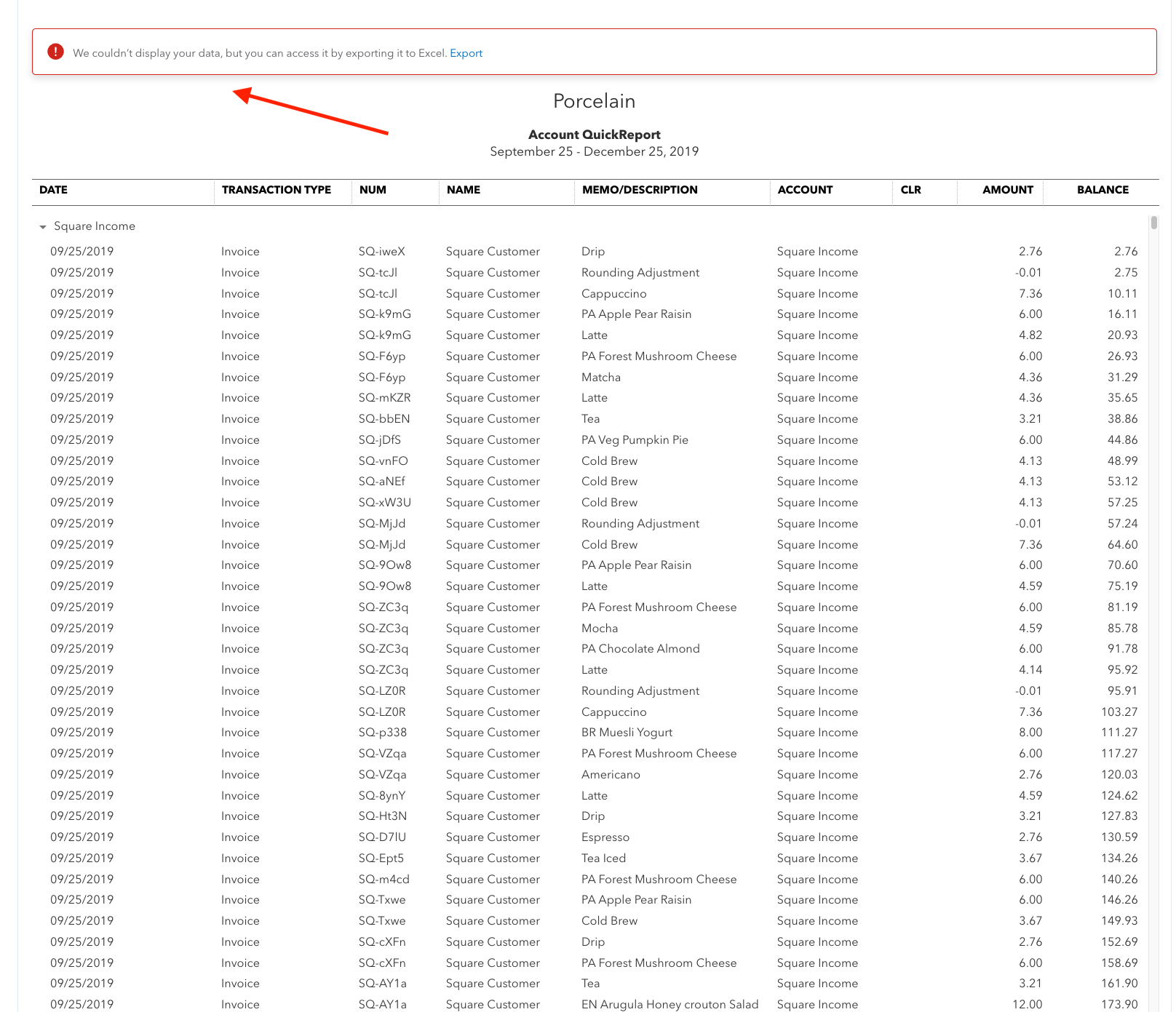

The Challenge with Single Order Entries

Many accounting integrations record sales at the individual order level, creating a separate invoice or sales receipt for every transaction. While detailed, this approach can overwhelm your accounting system—especially for high-volume businesses. For example, a coffee shop selling 500 drinks daily generates roughly 15,000 transactions monthly. Recording each sale individually results in thousands of invoices, making error tracking and reconciliation time-consuming and complex.

Moreover, this level of detail is rarely necessary for financial reporting and can always be retrieved from the source system (like Square, Shopify, or Stripe). At Bookkeep, we take a more streamlined approach to ensure clean, accurate, and actionable accounting data.

The Benefits of Summary Entries

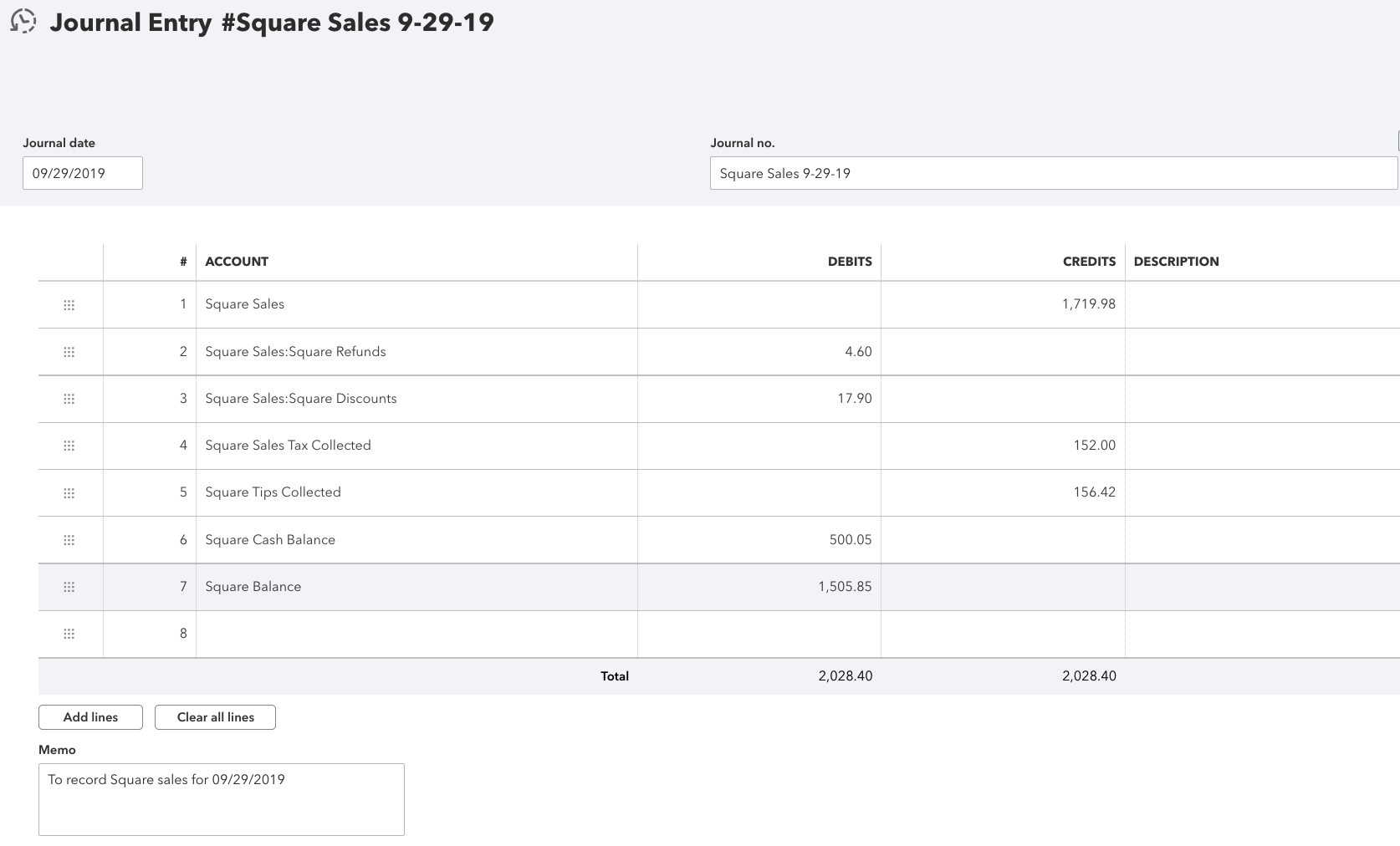

Summary entries consolidate all daily transactions into a single journal entry (per currency), capturing total sales, payouts, and fees within a 24-hour period. This simplifies account review and reconciliation while aligning with how businesses typically receive batched daily deposits from payment processors—rather than individual transaction transfers.

Practical Example

Instead of 150 separate invoices cluttering your books, a single summary entry captures the day’s total sales while allocating amounts correctly across accounts, including sales tax, discounts, payment types, etc.

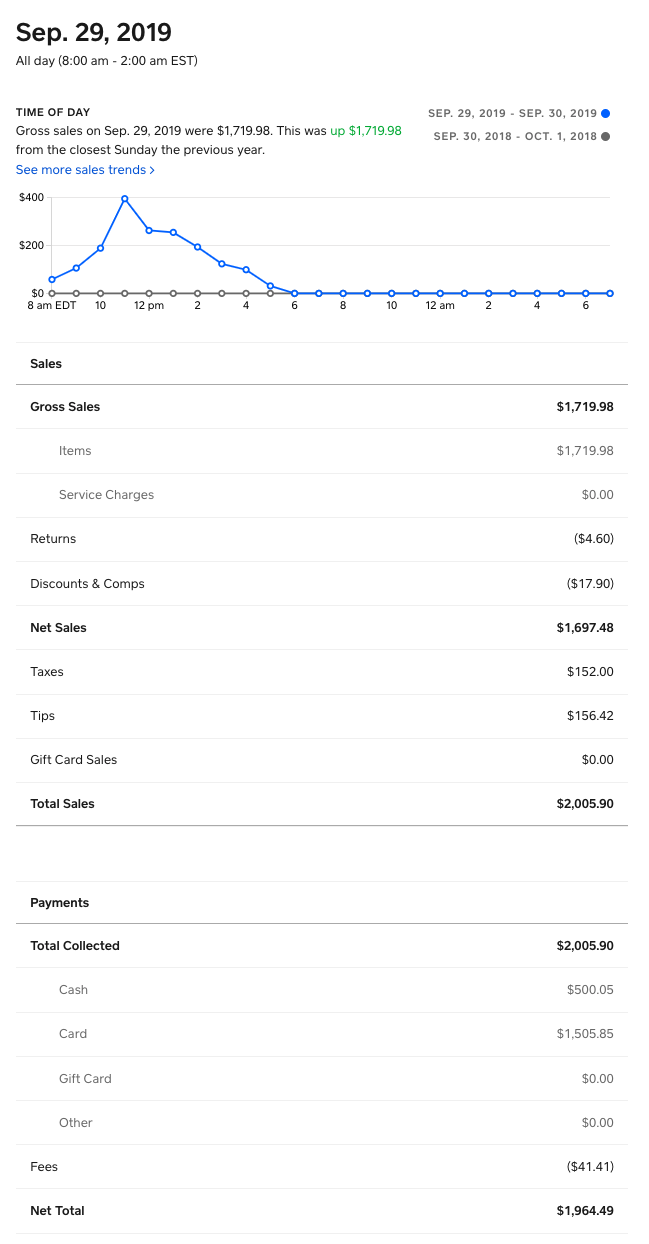

Daily report from source (Square)

Summarized Journal Entry (Square Sales)

We also support subcategory mapping based on your source system setup. For instance, Square sales can be categorized into Food, Beverages, and Coffee, and then posted to the appropriate sub-accounts—provided items are properly configured in Square.

For more information or assistance, contact support@bookkeep.com. We’re here to help you simplify and optimize your accounting workflow.