How to Reconcile a Balance or Clearing Account

Why Reconciliation Matters

Reconciling a balance or clearing account is an essential step in ensuring accurate financial reporting. This process compares the balance reported by a third-party platform—such as an ecommerce marketplace or point-of-sale (POS) system—to the balance recorded in your company’s general ledger.

Because timing differences, data-entry errors, or missing transactions can occur, discrepancies between the two systems are common. Investigating and correcting these variances ensures that every transaction is properly recorded and that your financial statements reflect the true position of your business.

The primary goal of reconciliation is to confirm that all transactions in both the third-party platform and the general ledger are captured accurately and that the ending balances match. Regular reconciliation protects the integrity of your books, helps detect errors or fraud, and provides the confidence needed to make sound financial decisions.

Common Causes of Discrepancies

Differences between platform balances and your accounting records can stem from:

-

Timing gaps (e.g., pending deposits, settlement delays, or timezone cutoffs)

-

Missing or duplicate entries in either system

-

Data-entry errors or misclassified transactions

Resolving these issues may require reviewing transaction reports, verifying fees or transfers, and sometimes coordinating with the third-party platform to clarify discrepancies.

Example: Reconciling a Stripe Balance Account

Consider a business that processes all sales through Stripe.

-

Sales activity increases the Stripe balance as charges are collected.

-

Payouts to the bank and Stripe fees decrease the balance.

At the end of each month, Stripe may still hold a remaining balance that must be reconciled with your accounting records.

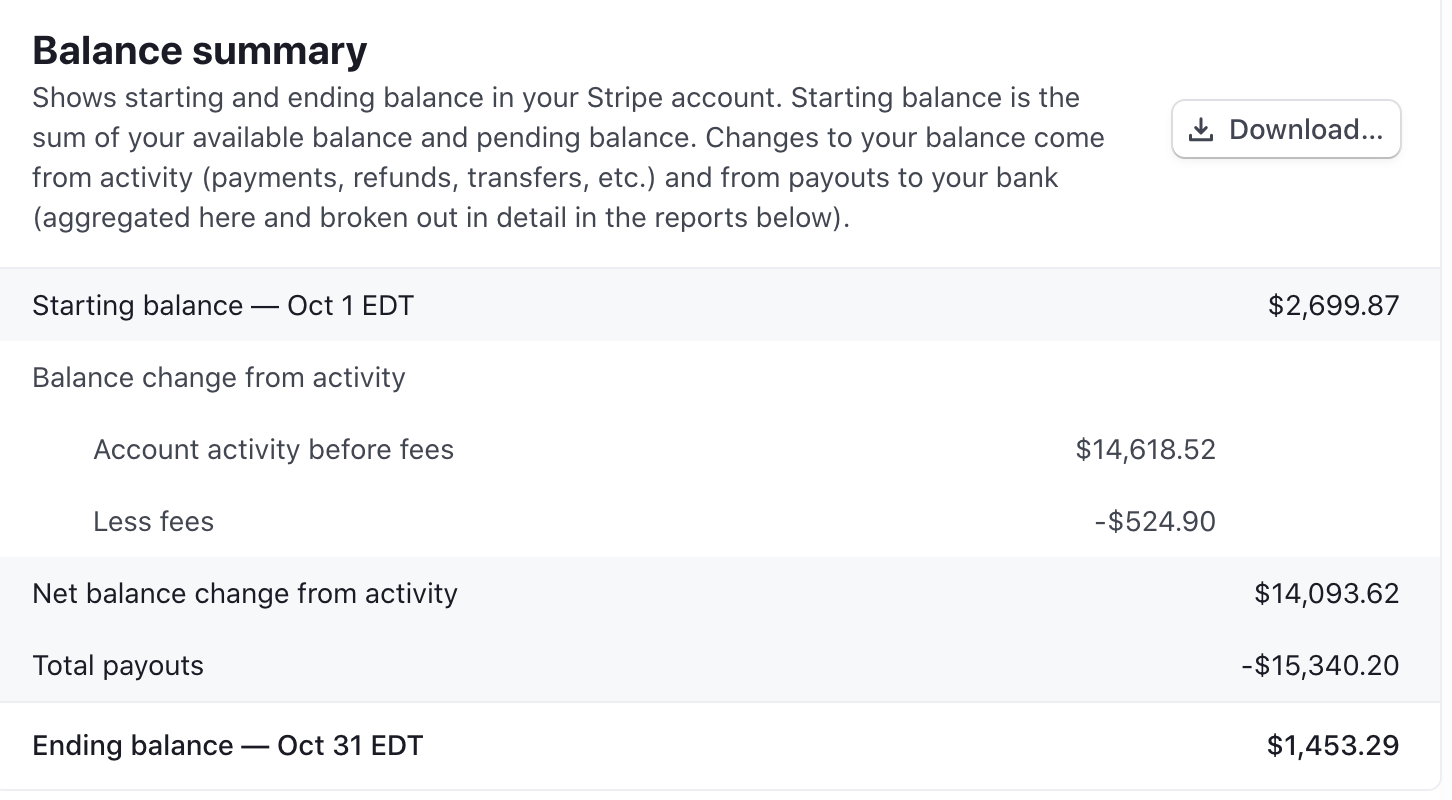

Step 1: Confirm the Opening Balance

Start with the opening balance (last month’s closing balance) and confirm it matches your general ledger.

For example, if Stripe shows an opening balance of $2,699.87, ensure the same figure appears in your accounting platform. If you are a new business, this amount may be zero.

The balance can be affected by the timezone, as shown in the example above (Timezone is EDT). If a deposit is made close to the timezone cutoff and the wrong timezone is applied, the balance may not match up.

Step 2: Verify All Increases

Identify all increases to the balance during the month—such as new sales, charges, or gift card activity—and confirm they are recorded in your accounting system.

In this example, Stripe shows $14,618.52 in total increases. Your accounting platform should reflect the same total for monthly debits (or increases) to the balance account.

Step 3: Verify All Decreases

Next, review all decreases, such as refunds, Stripe fees, or payouts to your bank.

In this scenario, total decreases are $15,865.10 ($524.90 in fees plus $15,340.20 in payouts). Your accounting platform should show an equal amount of credits (or reductions) to the balance account.

Step 4: Confirm the Ending Balance

Calculate the ending balance using the formula:

Opening Balance

+ Total Increases

– Total Decreases

= Ending Balance

Based on the example:

$2,699.87 + $14,618.52 – $15,865.10 = $1,453.29

This $1,453.29 should match the ending balance in both Stripe and your accounting platform.

Investigating Discrepancies

If the balances don’t match, check for:

-

Transactions recorded in the wrong account

-

Payouts or fees missing from your books

-

Incorrect opening balances

-

Timing differences due to settlement delays or timezone settings

Correct any errors so that the accounting balance agrees with the third-party system.

Keeping Reconciliation Simple

Regular reconciliation—at least monthly—helps maintain clean books, detect issues early, and ensure financial transparency.

Bookkeep can help automate this process by posting daily entries for sales, fees, and deposits, making monthly reconciliation faster and more accurate.

For assistance, contact support@bookkeep.com.