Cash versus Accrual accounting

When managing business finances, two common methods are accrual accounting and cash basis accounting. Understanding the difference is essential for accurate financial reporting and decision-making.

Accrual Accounting

Under accrual accounting, revenue is recorded when it is earned and expenses are recorded when they are incurred, regardless of when cash is received or paid. This method provides a clearer, more complete picture of a company’s financial health by matching income and related expenses in the same period. It is often preferred by businesses that need to track accounts receivable, accounts payable, inventory, or long-term obligations.

Cash Basis Accounting

Cash basis accounting records revenue only when payment is received and expenses only when payment is made. This approach is simpler and easier to maintain but can give a misleading view of profitability, since it ignores money owed to the business or upcoming liabilities until cash actually changes hands.

Deposits vs. Revenue

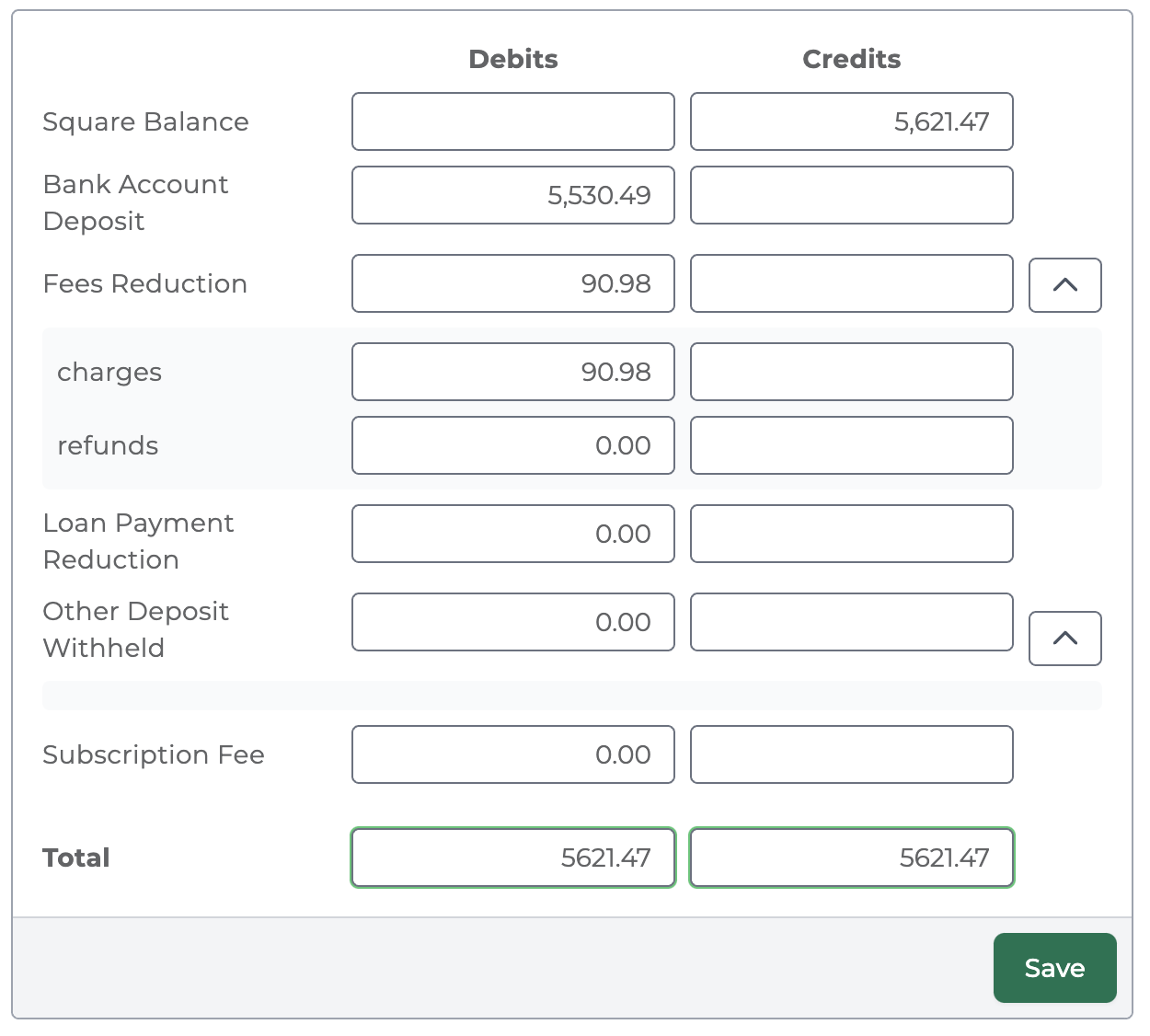

A customer deposit does not necessarily equal revenue. For example, a single bank deposit might include sales revenue, sales tax, shipping income, and gift card liabilities, minus processing fees or loan withholdings. Breaking these elements out ensures that only true revenue is recognized.

(+) Sales revenue

(+) Sales tax

(+) Shipping income

(+) Gift card liability

(-) Processing fees

(-) Loan withholdings

= Deposit to your bank

For more information on how Bookkeep can help you make more informed financial decisions, please visit our website and start a free trial today.